CHARLOTTE, NC and NEW YORK (January 19, 2023) – Crescent Communities and Pretium are pleased to announce leasing will begin soon at HARMON Five Points, the fourth build-to-rent (BTR) community under development, and the second in Charlotte, as part of their previously announced joint venture. The community is comprised of 76 BTR homes with accompanying shared amenities. Progress Residential, Pretium’s single-family rental management services platform, is providing the leasing and property management services.

HARMON Five Points offers residents the option to rent three-story townhomes with three bedrooms, three and a half baths, outdoor balconies, private garages, and driveways. Interior finishes include modern, stainless-steel appliances, granite countertops, elevated flooring, spacious nine-foot ceilings, ample window exposure for natural light, and SMART home technology. The community is the first for the HARMON brand to be certified by the National Green Building Standard (NGBS), a residential building certification for sustainable construction and development. Each home is designed to be energy and water efficient, while offering residents a greater degree of comfort and lower utility bills.

Residents of HARMON Five Points will also have access to dedicated communal spaces such as a fire pit with outdoor lounge seating, a lawn area for gatherings and pets, and a direct connection to Five Points Park and Stewart Creek Greenway. HARMON Five Points is located two miles from Uptown and is walking distance from the Gold Line Streetcar.

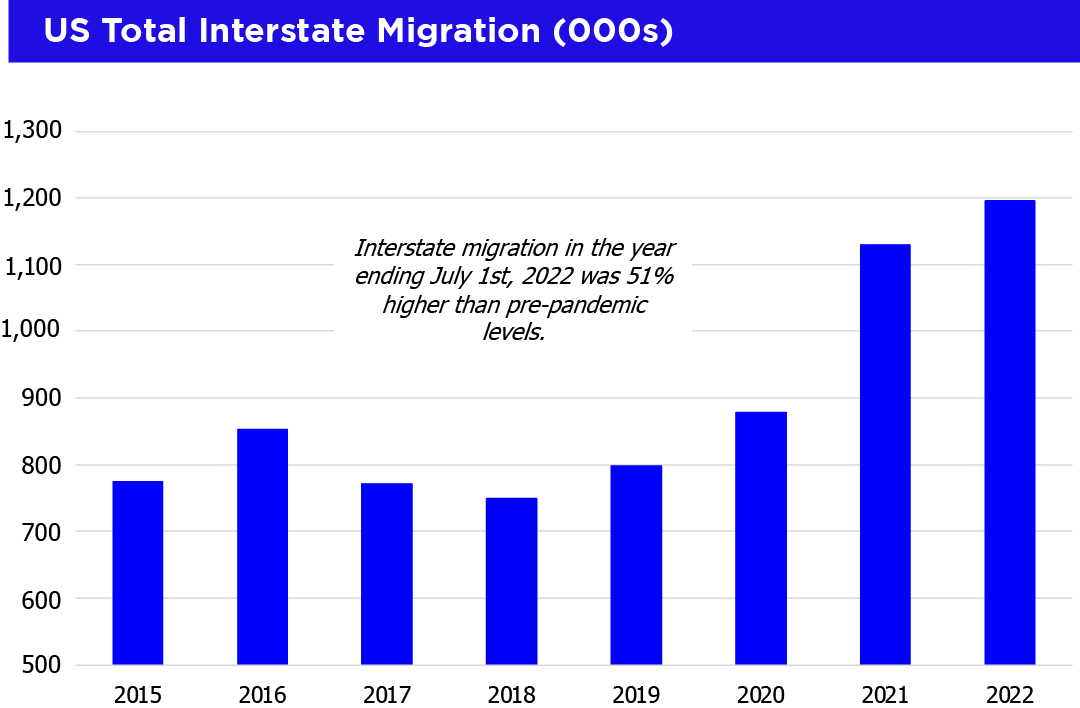

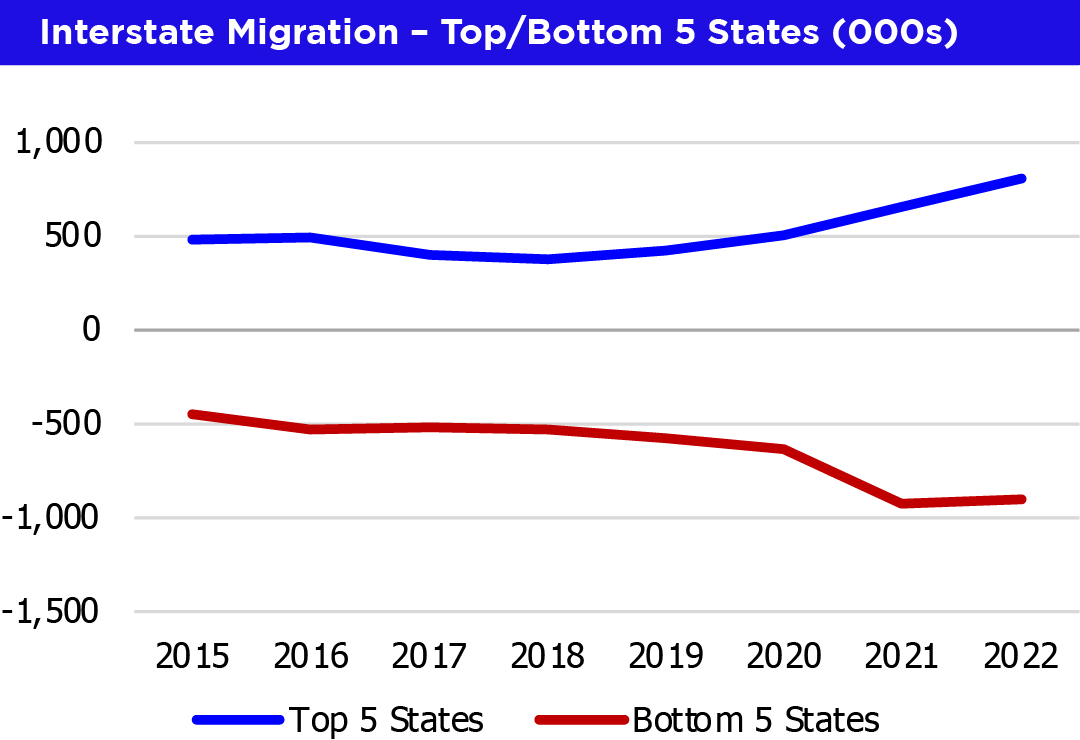

“HARMON Five Points offers a much-needed new construction infill housing option to the historic West End neighborhood to accommodate the migration and population growth in Charlotte over the past several years,” said Tony Chen, Senior Managing Director of Single-Family Build-to-Rent at Crescent Communities. “We are pleased to have reached the leasing milestone ahead of schedule, and are also excited for the NGBS Bronze certification achievement. Stewardship is fundamental to Crescent Communities’ mission to build community and better people’s lives, and we are excited to extend our commitment to stewardship into our BTR platform through our goal of achieving NGBS Bronze or greater on each HARMON home. We strive to have a positive impact on the planet, people, and places we build and call home, and we look forward to seeing the HARMON Five Points community flourish.”

“Pretium is a leading investor in homes throughout some of the most desirable areas across the country, and we are thrilled to have another build-to-rent community welcome residents—bringing our total footprint in the Charlotte market to more than 5,300 homes and demonstrating our commitment to housing choice across growing regions,” said Matt Johnston, Managing Director and Head of Build-to-Rent at Pretium. “In addition to increasing housing access and offering consumers more choices, HARMON Five Points is delivering modern, sustainable homes that will be an important addition to the Charlotte community for years to come. We are committed to continuing our investments to increase the supply of move-in ready homes and contribute to the long-term health of our communities.”

HARMON Five Points is located at 360 Seldon Drive, Charlotte, NC, and was constructed by DRB Group. Additional partners include lender Atlantic Union Bank, landscape architect LandDesign and architectural review by 505Design. Progress Residential, which currently oversees more than 90,000 homes, is a market leader, with the people, technology, scale, and data-driven solutions that streamline operations, optimize asset performance, and provide an exceptional renting and living experience for residents.

Imagery of HARMON Five Points is available here and floorplans can be found here. For more information, please visit: www.liveatharmon.com and rentprogress.com.

About Crescent Communities

Crescent Communities is a nationally recognized, market-leading real estate investor, developer and operator of mixed-use communities. We create high-quality, differentiated residential and commercial communities in many of the fastest growing markets in the United States. Since 1963, our development portfolio has included more than 83 multifamily communities, 24 million square feet of commercial space and 60 single family master-planned communities. Crescent Communities has offices in Charlotte, DC, Atlanta, Orlando, Nashville, Dallas, Denver, Phoenix and Salt Lake City. Our residential communities are branded NOVEL, RENDER and HARMON by Crescent Communities and our industrial developments are branded AXIAL by Crescent Communities and our life science developments are branded THE YIELD by Crescent Communities.

About Pretium

Pretium is a specialized investment firm focused on U.S. residential real estate, residential credit, and corporate credit. Pretium was founded in 2012 to capitalize on investment and lending opportunities arising as a result of structural changes, disruptions, and inefficiencies within the economy. Pretium has built an integrated analytical and operational ecosystem within the U.S. housing, residential credit, and corporate credit markets, and believes that its insight and experience within these markets create a strategic advantage over other investment managers. Pretium’s platform has approximately $50 billion of assets, comprising real estate investments across 30 markets in the U.S., and employs more than 4,000 people across 30 offices, including its New York headquarters, Dubai, London, Seoul and Sydney. Please visit www.pretium.com for additional information.

About Progress Residential

Progress Residential is a market leader in intelligent single-family rental management services, with people, technology, scale and data-driven solutions that streamline operations, optimize asset performance, and provide an exceptional renting and living experience for our residents. Progress Residential’s approximately 3,000 employees currently manage approximately 90,000 homes across 30 markets. Progress Residential also offers third-party property management service for investors with mid-to-large single-family rental home portfolios and Built to Rent communities through its Progress Residential Management Services. For more information, please visit www.rentprogress.com