The aging U.S. housing stock, slow new home construction pace, and postpandemic shifts in housing utilization create strong tailwinds for housing rehabilitation and remodeling activity

Rehabitation and remodeling are important tools in addressing the U.S. housing undersupply problem

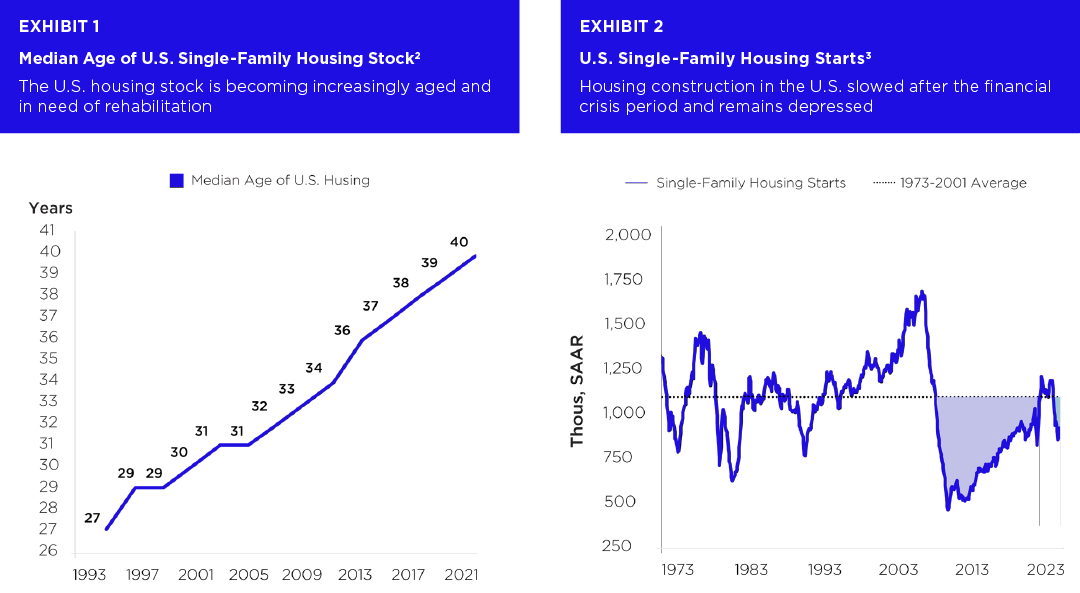

A recent Harvard study notes that across the U.S., 49% of owner-occupied housing was built before 1980; in certain geographic areas – including Boston, New York and Los Angeles – two-thirds or more of the owner-occupied homes were built before 1980.1 The aging of the U.S. housing stock is a consequence of the sharp slowdown in new home construction that began in 2007 and that has extended through 2023, per Exhibits 1-2 below.

The continued aging and deterioration of the U.S. housing stock points to a large market of homes in need of rehabilitation. The 2023 Harvard study notes that recent improvement spending has focused not just on cosmetic enhancements but has also been directed at core replacements of basic housing components including roofing and HVAC systems which have extended beyond their functional lifetimes.1 Pretium and our affiliated lending partner Anchor Loans believe that modernization and rehabilitation of the already existing U.S. housing stock will play an important role in addressing the general problem of housing undersupply across the country. Further, it is likely that the extensive amount of modernization required for many homes will be difficult for typical homeowners to manage and finance; rather, such extensive rehabilitation will often be most conveniently executed by professional developers who purchase homes for sale, bring them up to modern standards, and then subsequently resell the homes once the improvements are complete.

Post-pandemic shifts in living patterns provide additional positive impulse for home improvement

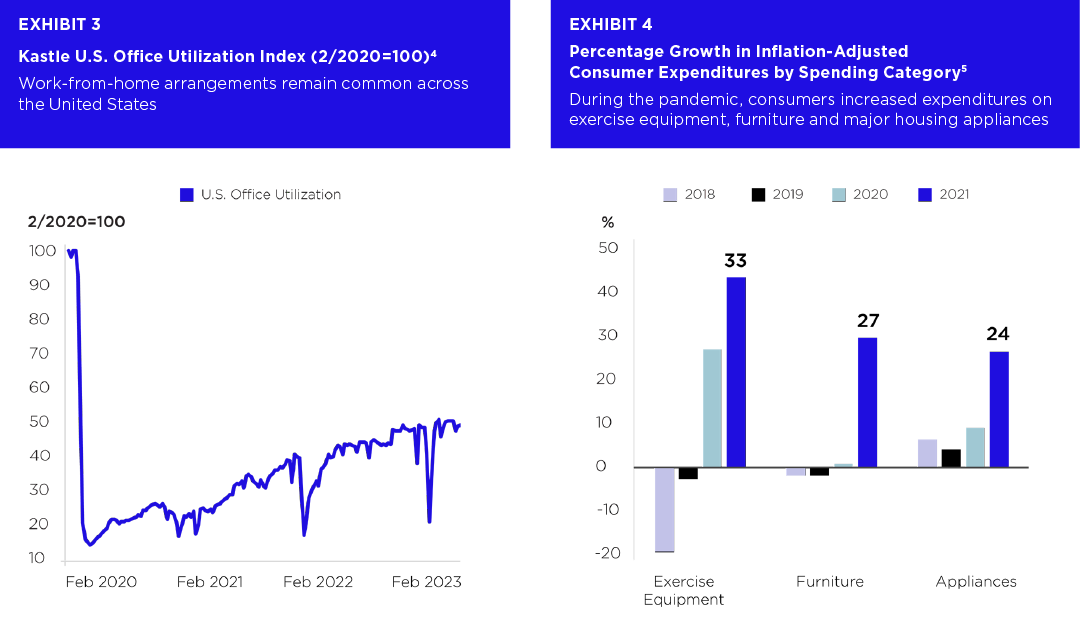

Post-pandemic changes in patterns of housing activity are another force that is likely to put upward pressure on the demand for home improvements. Measures of U.S. office space occupancy remain at below 50% of pre-COVID levels, now three years after the initial pandemic shock (Exhibit 3), suggesting that the move towards work-from-home has become structural. Exhibit 4 relatedly shows a large increase in inflation-adjusted consumer spending on categories such as exercise equipment and furniture since the start of the pandemic. With the growing amount of both work and leisure activity taking place at home, homeowners will demand newer and better housing features that can support these pursuits. Again, it is likely that the extensive home remodeling needed to bring housing quality and size up to the level that can facilitate increased home-centered living activity will often be most efficiently executed by professionals with access to scale economies and efficient and stable financing vehicles.

Demographic trends are supportive of housing rehabilitation

Not only is the U.S. housing stock aging, the population of U.S. homeowners and homebuyers is aging as well. The National Association of Realtors has noted that over 40% of all the 2022 U.S. home purchases were made by homebuyers from the so-called baby-boomer or silent generation cohorts6; per Exhibit 5, the share of homes purchased by older homebuyers has trended higher over the past two decades. An older homebuying population will likely be supportive of housing rehabilitation activity: the Harvard home improvement study notes that older homeowners will tend, for example, to value homes modified for improved accessibility and safety. Older homebuyers also have relatively high levels of average net wealth, per Exhibit 6 below, to help facilitate the purchase of improved homes.

The aging of the U.S. housing stock, combined with post-pandemic shifts in lifestyles that benefit from expanded and modernized single-family housing, and demographic trends leading towards an elevated share of older homebuyers, are strong tailwinds for the housing rehabilitation industry. Pretium and Anchor Loans remain constructive on the long-term outlook for the professional home improvement sector and look forward to playing a role in the ongoing process of rehabilitation of the U.S. housing supply.

This is not an offer, advertisement, or solicitation for interests in any Pretium managed vehicle and should not be construed or relied upon as investment advice or as predictive of future market or investment performance. Past performance is not indicative of future results.

1. “Improving America’s Housing 2023”, Harvard Joint Center for Housing Studies, March 2023.

2. American Community Survey, Pretium. Data as of December 2021.

3. Census Bureau, Pretium. Data as of February 2023.

4. Kastle, Pretium. Data as of April 2023.

5. BLS, Pretium. Data as of December 2021.

6. “2022 Home Buyers and Sellers Generational Trends Report”, NAR, March 2023. Boomer and Silent Gen cohorts are defined as the groups born during 1946-1964 and 1925-1945, respectively.

7. FHFA National Mortgage Database Program, Pretium. Data through June 30, 2022.

8. “2022 Home Buyers and Sellers Generational Trends Report”, NAR, March 2023.