Summary

Increased long-distance migration persisted in 2022

The pandemic is likely to have a structural, long-term impact on housing demand

One of the most important debates about the pandemic’s impact on the housing market is whether the surge in demand that began in mid-2020 is a temporary or structural phenomenon. There are numerous indicators of structural pandemic driven changes in household behavior, including the persistence of work-from-home,1 increased online shopping,2 a greater focus on wellness,3 and elevated business formations.4 However, many investors still question whether the pandemic simply pulled forward housing demand, especially since rising rates have obscured underlying trends. Consumer surveys find that households continue to expect the pandemic to have a permanent impact on their housing choices.5 Also, recently released data from the Census indicates that the pandemic boost to long distance migration accelerated well into 2022 even as many other aspects of life returned to prepandemic patterns.6 The Census data is notable because it is a direct measurement of long-distance migration whereas indirect measurements of migration such as postal change of address forms had indicated that migration slowed during 2022.7

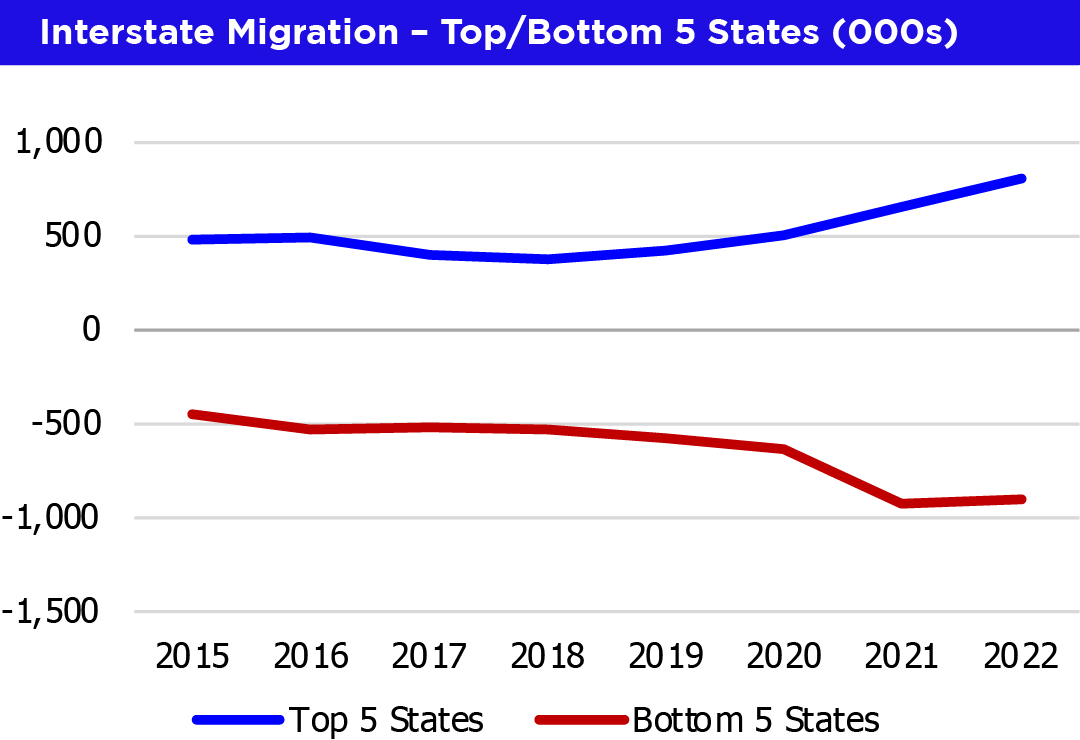

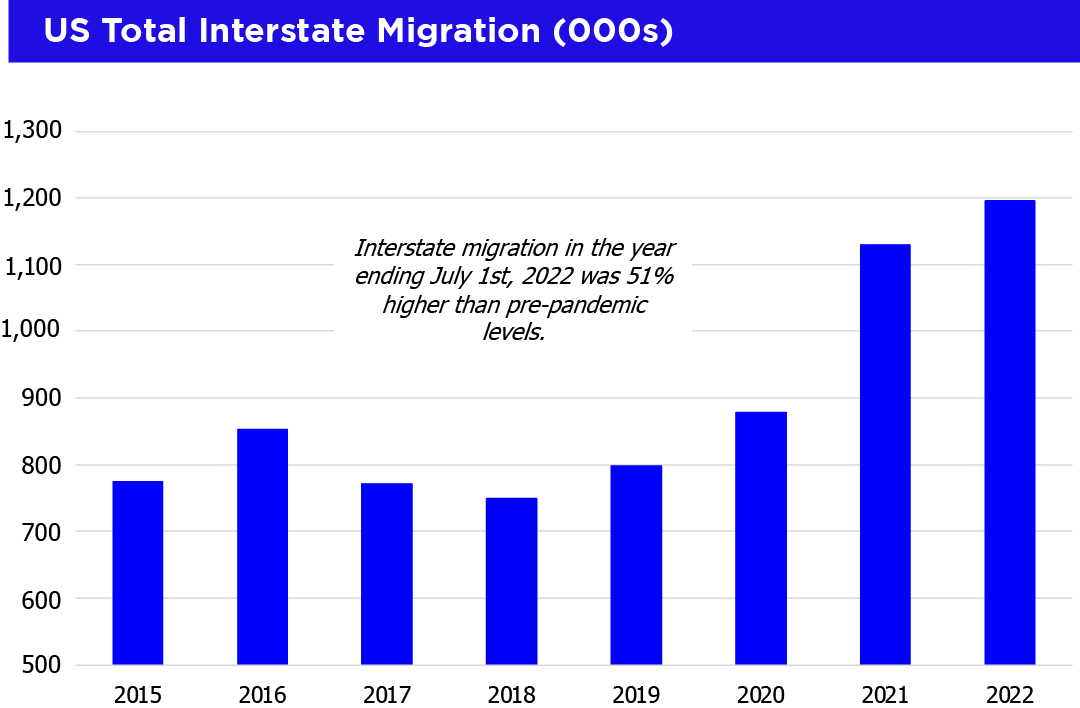

As shown in Exhibit 1, interstate migration increased meaningfully in the year ending July 1, 2021 – the first year of the pandemic. If the pandemic’s impact on housing demand was mainly temporary in nature, migration levels should have slowed in the second year of the pandemic as its impact on day-today life waned. Instead, interstate migration increased further in the year ending July 1, 2022 to 1.5x pre-pandemic levels. As shown in Exhibit 2, the increase in migration was a combination of larger outflows from states such as California and New York as well as larger inflows into states such as Florida and Texas. Migration levels are likely to decrease as higher mortgage rates and a slowing economy limit households’ financial ability to move; however, online home search activity indicates that the desire to move to a different metro continued to increase in 2H22.8 Pretium believes that migration data demonstrates the likely structural impact of the pandemic on long-term housing demand and that this increased demand should become apparent again as economic and rate pressures ease.

Exhibit 1

Exhibit 2

Source: US Census, Population and Housing Unit Estimates, 2022 Vintage as of December 2022. Years are measured from July 1 to July 1. Top 5 states are Florida, Texas, North Carolina, South Carolina and Tennessee; Bottom 5 states are California, New York, Illinois, New Jersey and Massachusetts.

Want more Housing Insights from Pretium?: Expanding Build-to-Rent Construction Increases Housing Supply and Preserves Rental Access

Statements above regarding the housing market represent the opinions and beliefs of Pretium. There can be no assurance that these will materialize. This is not an offer, advertisement, or solicitation for interests in any Pretium managed vehicle and should not be construed or relied upon as investment advice or as predictive of future market or investment performance. Past performance is not indicative of future results.

1. Barrero, Bloom & Davis, “Why working from home will stick,” National Bureau of Economic Research Working Paper 28731. Data as of January 17, 2023.

2. US Census, Monthly Retail Trade Quarterly E-Commerce Report, Data as of November 18, 2022.

3. McKinsey & Company, “Still feeling good: The US wellness market continues to boom”, September 19, 2022. Placer.AI Quarterly Index – Q4 2022, January 2023.

4. US Census, Business Formation Statistics, Data as of January 17, 2023.

5. UBS, “UBS Evidence Lab inside: 4Q housing intentions remain resilient despite affordability headwinds”, January 5, 2023.

6. US Census, Population and Housing Unit Estimates, 2022 Vintage. Data as of December 2022.

7. Bloomberg, “Urban Migration Slows in 2022 for Many Major US Cities”, September 3, 2022.

8. Redfin, “Homebuyers Are Flocking To The Sun Belt, Attracted To Relatively Affordable Home Prices”, December 19, 2022.