The share of US rental housing that is single-family has been falling since 2014

SFR is the only major real estate asset class to see supply shrink in recent years

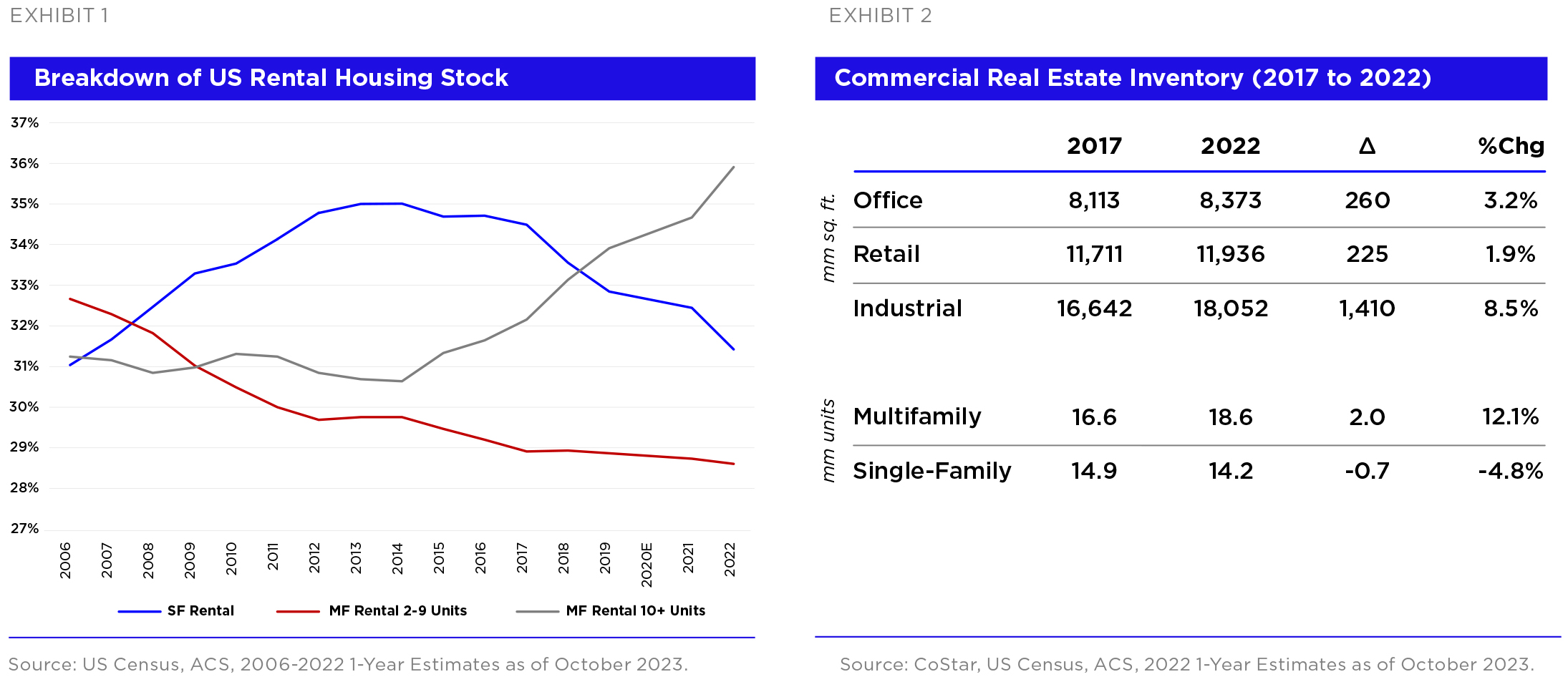

Measuring single-family rental supply is important to evaluating supply-demand fundamentals; however, there is limited data on the subject. There are several frequently quoted sources that attempt to measure investor buying activity;1 however, they don’t accurately capture trends in supply because they mostly ignore sales of single-family rentals back to the homeownership market; moreover, the difficulty of working with tax and county records results in widely varying conclusions about investor buying activity. We explored this in the October 2022 Pretium Housing Insights.2 The US Census American Community Survey (ACS) provides the only national annual count of the number of single-family rentals in the US. 2022 ACS data was recently released, and it shows that the supply of single-family rentals continued to decline last year.3 The overall supply of single-family rentals has now been falling for six consecutive years, including through the pandemic. Combined with multifamily supply that has increased meaningfully over the past decade, single-family homes have accounted for a steadily shrinking share of US rental housing since 2014, as shown in Exhibit 1. At 31.4%, single-family rental share in 2022 is almost as low as it was in 2006 when home ownership was near all-time highs.4

The long-term trend of declining single-family rental supply stands in contrast to supply trends for other major US real estate asset classes, which have all seen net supply growth over the past five years including through the pandemic. As shown in Exhibit 2, Industrial has added 1.4 billion in square footage over the past five years representing 8.5% growth. The multifamily sector has seen a net increase in units of 2 million or 12.1%. Robust supply growth in the asset types that investors have most focused on makes sense; however, it is more surprising that office and retail have also experienced net growth in square footage of 260 million (+3.2%) and 225 million (+1.9%), respectively, over the past five years. We described in last month’s Pretium Housing Insights5 how investment in single-family housing has grown over the long-term; however, ACS data reveals that most of this investment has gone towards owneroccupied housing, not rental housing. Single-family rental stock has shrunk by more than 700,000 over the past five years, or a decrease of 4.8% while single-family owned stock has increased by roughly 7 million.6 Overall, the increase in investor interest in single-family rentals in recent years hasn’t been sufficient to drive supply higher. Looking ahead, continued home price growth and economic/rate volatility are likely to depress single-family rental supply further in the coming years as smaller investors remain motivated to sell more homes than they buy.

Statements throughout the research above represent the opinions and beliefs of Pretium. There can be no assurance that these will materialize.

- CoreLogic, US Home Investor Share as of August 17, 2023; Redfin, Real Estate Investors Data as of August 30, 2023; National Association of Realtors, Impact of Institutional Buyers as of May 2022; Freddie Mac, Drivers of Home Price Growth as of June 9, 2022.

- Pretium Housing Insights, “Investor activity in housing had no discernible impact on homeownership during the pandemic”, October 2022.

- US Census, American Community Survey 2022 1-Year Estimates as of September 14, 2023.

- US Census, Housing Vacancies and Homeownership as of August 2, 2023.

- Pretium Housing Insights, “Resilient single-family home prices have diverged from commercial real estate prices”, September 2023.

- US Census, American Community Survey 2017 and 2022 1-Year Estimates as of September 14, 2023