CLO equity provides a unique format to invest in high-yield corporate loans

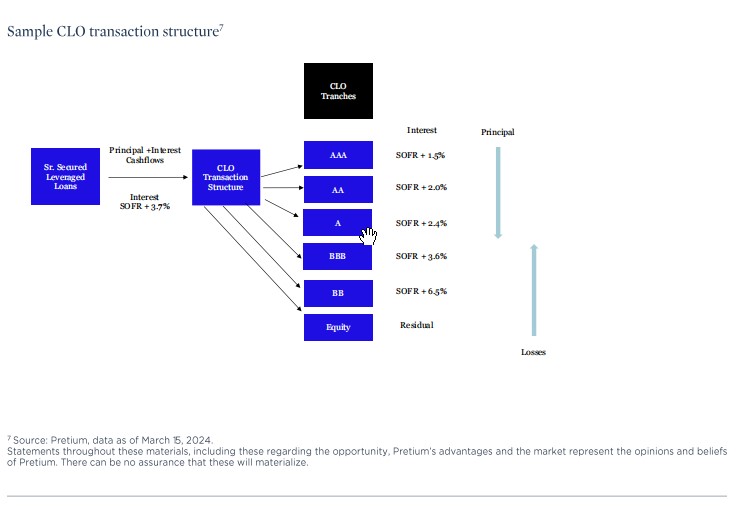

Collateralized loan obligations are investment vehicles that securitize a diversified portfolio of senior secured corporate loans – sometimes referred to as leveraged loans – and then distribute the loan portfolio’s cashflows to a range of end investors. The equity tranche of a CLO transaction is entitled to all of the principal and interest payments made by the underlying loan portfolio, net of interest and principal payments distributed to the CLO debt securities senior to the equity tranche. Thus, a key attribute of CLO equity, as it relates to the priority of payments received, is that CLO equity receives regular periodic payments representing the excess interest generated by the difference between the loan portfolio income and the CLO debt security cost, on a current basis.

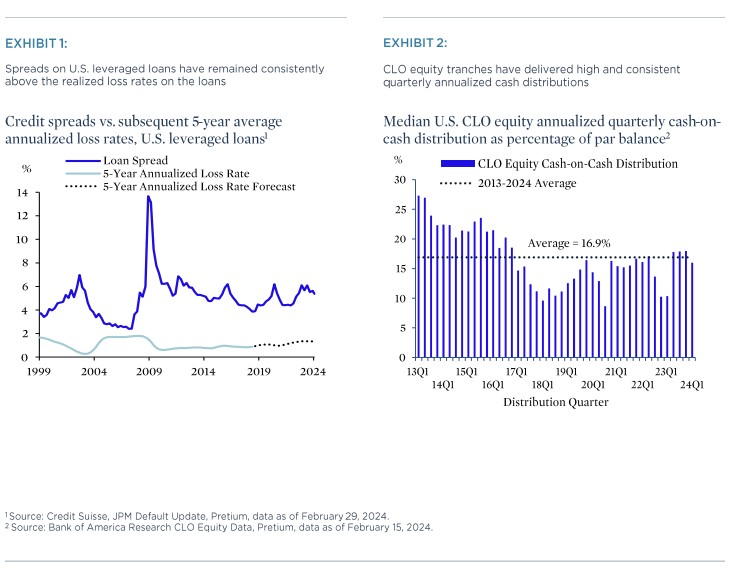

The senior secured, high-yield corporate loans that back CLO transactions have historically been attractive assets to own, as their spreads have remained well above the loans’ realized credit losses. Exhibit 1 below shows that leveraged loan spreads have averaged 5% (500bp) over the past 25 years while leveraged loan losses have averaged only 1% (100bp) over the same period, highlighting the potential for the loans to generate positive long-run excess returns.

CLO equity is, in turn, a particularly unique format through which to gain exposure to high-yield corporate loans. The CLO structure – as shown, e.g., in the Appendix of this report – provides non-recourse, non-mark-to-market term leverage, which enhances the baseline yields of the loans themselves, without incurring risks of margin calls which may occur when using more traditional forms of leverage such as repo financing. Additional positive features of the CLO equity asset class include multiple embedded options, such as the option to refinance senior CLO debt when conditions are favorable and the option to actively manage the underlying CLO loan portfolio through asset sales and purchases, and limited interest rate risk exposure due to the floating-rate nature of the CLO assets and liabilities.

The beneficial features of CLO equity listed above have helped the sector to generate high and consistent quarterly cashflow distributions over time. Exhibit 2 above shows that CLO equity cash-on-cash returns have historically averaged 16.9%, annualized, when expressed as a percentage of the equity tranche par value; when these cash distributions are expressed as a percentage of acquisition value (purchase price), they further increase, as new issue equity is typically issued at a discount to par and seasoned secondary market equity often trades at a significant discount to par. As an example, if the equity tranches are acquired in the secondary market at a $90 price, as is often feasible, then the average annual cash-on-cash return as a percentage of purchase price becomes 18.5%; if the tranche acquisition price is $75, then the cash-on-cash return becomes 22.5% annualized.

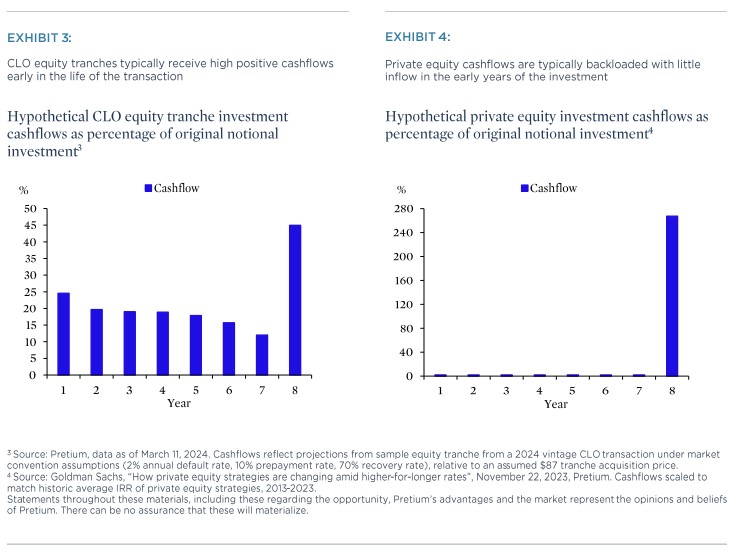

Notably, the distributions to CLO equity usually begin on the first payment date and continue on a quarterly basis over the life of the investment, as is shown in Exhibit 3 for a hypothetical equity tranche. The resulting cash flow profile compares favorably to traditional private equity investments, which commonly exhibit a “J-curve” profile in which the investment delivers negative returns/no cash flow in the initial years of the transaction, hopefully to be offset by positive returns and return of capital in later years as the investment matures, as per Exhibit 4.

Growth of U.S. CLO market allows equity investors to allocate selectively

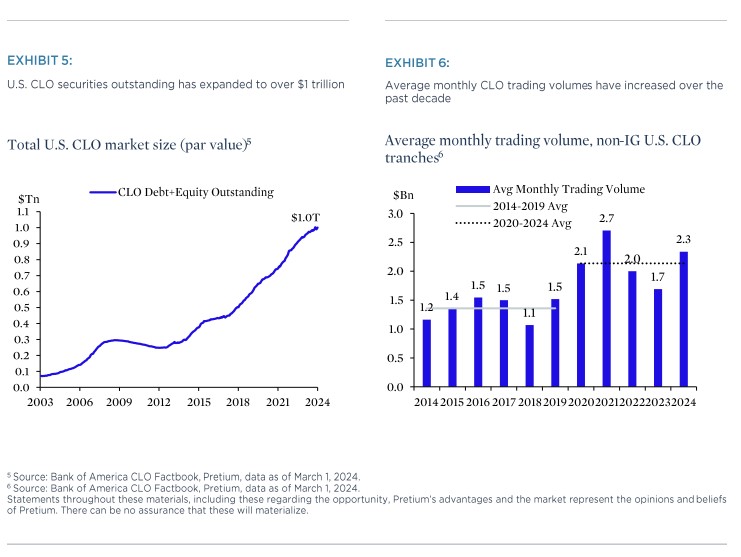

The U.S. CLO asset class has expanded to over $1 trillion of securities outstanding, from less than $500 billion in 2017, making CLOs now the largest securitized credit asset class in the U.S. (Exhibit 5). The growth of the CLO market is in large part a consequence of the sector’s historic success in delivering solid returns to investors through multiple cycles including the global financial crisis and COVID-19, while providing a dependable source of financing to a large and growing segment of corporate borrowers. The growth of the CLO market has led to improved trading liquidity for the asset class (e.g., per Exhibit 6) and makes it possible for active CLO equity investors to focus upon specific sub-segments of the market in order to target particularly compelling risk-reward profiles while still remaining discriminating in terms of security selection. For example, as market volatility and price dislocation increased in 2022 and 2023, Pretium adjusted its allocation strategy by overweighting secondary vs. primary market CLO equity positions and by overweighting CLO equity tranches backed by relatively defensive, lower risk loan portfolios. To the extent price dislocation moderates in 2024 and financing markets continue to become more accommodative, Pretium would expect to become more active in new issue markets again in order to lock in favorable debt terms which would benefit new issue CLO equity.

Conclusion: CLO equity is an attractive alternative for asset allocators looking to diversify their private credit exposure

CLO equity tranches have the potential to generate double digit returns over the long term while generating high current cash flow. The sector offers insulation from an uncertain future for interest rates and the large market footprint allows active investors to generate excess returns through tactical asset selection. Pretium believes the risk/reward characteristics of CLO equity to be a complementary component to any private credit allocation strategy today.

Appendix: Sample CLO Transaction Structure

CLO transaction structures distribute the principal plus interest cashflows from a pool of ~200 senior secured corporate loans to a range of equity and debt tranches.

Jerry Ouderkirk – Senior Managing Director, Head of Structured Credit

Jerry Ouderkirk is a Senior Managing Director and Head of Structured Credit at Pretium, where he has overall responsibility for the Firm’s corporate credit platform. In addition to overseeing and expanding the Firm’s CLO platform, Mr. Ouderkirk is building out numerous investing businesses across structured credit including Structured Corporate Credit.

Mr. Ouderkirk joined Pretium in 2017 with 20 years of experience building and committing capital around structured credit products and platforms. Prior to joining Pretium, Mr. Ouderkirk was a Partner at Goldman Sachs, where he started the Institutional Lending Group for Goldman Sachs Bank USA which oversaw the Firm’s discretionary lending and investing in the bank. He previously served as Global Co-Head of Structured Credit Trading, where he oversaw multiple capital committing businesses and started Goldman’s CLO Trading business, which he ran for more than 12 years.

Mr. Ouderkirk is a member of the Firm’s Executive Committee. He received a BA with honors in English and Economics from Colgate University. Mr. Ouderkirk serves on the Board of CitySquash in New York.

Confidentiality and Other Important Disclosures

This confidential presentation was prepared exclusively by Pretium for the benefit and internal use of the party to whom it is directly addressed and delivered (the “Recipient”). None of the materials, nor any content, may be altered in any way, transmitted to, copied, reproduced or distributed in any format in whole or in part to any other party without the prior express written consent of Pretium. As used in this presentation, “Pretium” refers to Pretium Partners, LLC and/or its affiliates.

Pretium’s Credit investment strategies are focused on corporate credit, structured products collateralized by corporate credit, distressed debt and equity and legal opportunities financing. The team invests in broadly syndicated loans, debt and equity of public and private companies, as well as securities issued by CLOs. Investments in high yield securities are subject to greater risk of loss of principal and interest than higher-rated securities and are generally considered to be predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal. Investments in distressed situations expose the investor to the difficulty in obtaining information as to the issuer’s true condition; legal risk, including laws relating to fraudulent conveyances, voidable preferences, lender liability, and bankruptcy; litigation risk; and liquidity risk. In addition, accounts will not be diversified among a wide range of types of securities, industry, markets, or countries. Litigation finance depends on whether the cases in which the fund invests will be successful, will pay the targeted returns and will pay those returns in the anticipated time. Assessing the values, strengths and weaknesses of a case is complex and the outcome is not certain. Should cases, claims, defenses or disputes in which the fund invests prove to be unsuccessful or produce returns below those expected, the performance of the fund could be materially adversely affected. Furthermore, laws and professional regulations in litigation funding can be complex and uncertain and details of certain cases are unlikely to be disclosed because of confidentiality and other restrictions.

There can be no assurance that Pretium’s objectives will be achieved, that any risk management will adequately protect against downside losses, or that an investor will receive any return on its investment. An investment should only be considered by persons who can afford a loss of their entire investment. Past activities of investment entities sponsored by Pretium provide no assurance of future results. Past or targeted performance is not a guarantee, projection or prediction and is not necessarily indicative of future results.

These materials do not constitute, or form part of, any offer to sell or issue interests in an investment vehicle or any other entity. Any such offer or solicitation will be made solely by means of a definitive offering document, which will describe the actual terms of any securities offered and will contain material information regarding the securities. Any information contained herein will be superseded by information delivered to Recipient as part of an offering document. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein.

Past performance is not necessarily indicative of future results and there can be no assurance that targeted returns will be achieved. There can be no assurance that Pretium will achieve results comparable to or that the returns generated will equal or exceed those of other investment activities of Pretium or that Pretium will be able to implement its investment strategy or achieve its investment objectives. Pretium does not make any representation or warranty, express or implied, regarding future performance.

Certain information contained in these materials constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “project,” “estimate,” intend,” continue,” “target,” “plan,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results of the actual performance of an investment vehicle or strategy may differ materially from those reflected or contemplated in such forward-looking statements.

Certain information contained in this presentation has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, Pretium has not independently verified such information nor does it assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof.

These materials are intended to assist the Recipient in connection with its due diligence and to assist the Recipient in understanding the strategies that Pretium intends to pursue to seek to maximize portfolio performance. They are not intended as a representation or warranty by Pretium as to the actual composition or performance of any future investments that would be made by Pretium. Assumptions necessarily are speculative in nature. It is likely that some or all of the assumptions underlying the potential investments will not materialize or will vary significantly from any assumptions made (in some cases, materially so). The Recipient should understand such assumptions and evaluate whether they are appropriate for its purposes.

Recipients should note that COVID-19 has, among other things, significantly diminished global economic production and activity of all kinds and has contributed to both volatility and a decline in all financial markets. The ultimate impact of COVID-19 — and the resulting precipitous and near-simultaneous decline in economic and commercial activity across several of the world’s largest economies — on global economic conditions, and on the operations, financial condition and performance of any particular industry or business, is impossible to predict, although ongoing and potential additional materially adverse effects, including a further global or regional economic downturn (including a recession) of indeterminate duration and severity, are possible. The extent of COVID-19’s impact will depend on many factors, including the ultimate duration and scope of the public health emergency and the restrictive countermeasures being undertaken, as well as the effectiveness of other governmental, legislative and financial and monetary policy interventions designed to mitigate the crisis and address its negative externalities, all of which are evolving rapidly and may have unpredictable results. Even if and as the spread of the COVID-19 virus itself is substantially contained, it will be difficult to assess what the longer-term impacts of an extended period of unprecedented economic dislocation and disruption will be on future macro- and micro-economic developments, the health of certain industries and businesses, and commercial and consumer behavior.