A portfolio of U.S. CLO equity and CLO BB debt securities should outperform HY bonds across a variety of potential future economic scenarios

Introduction

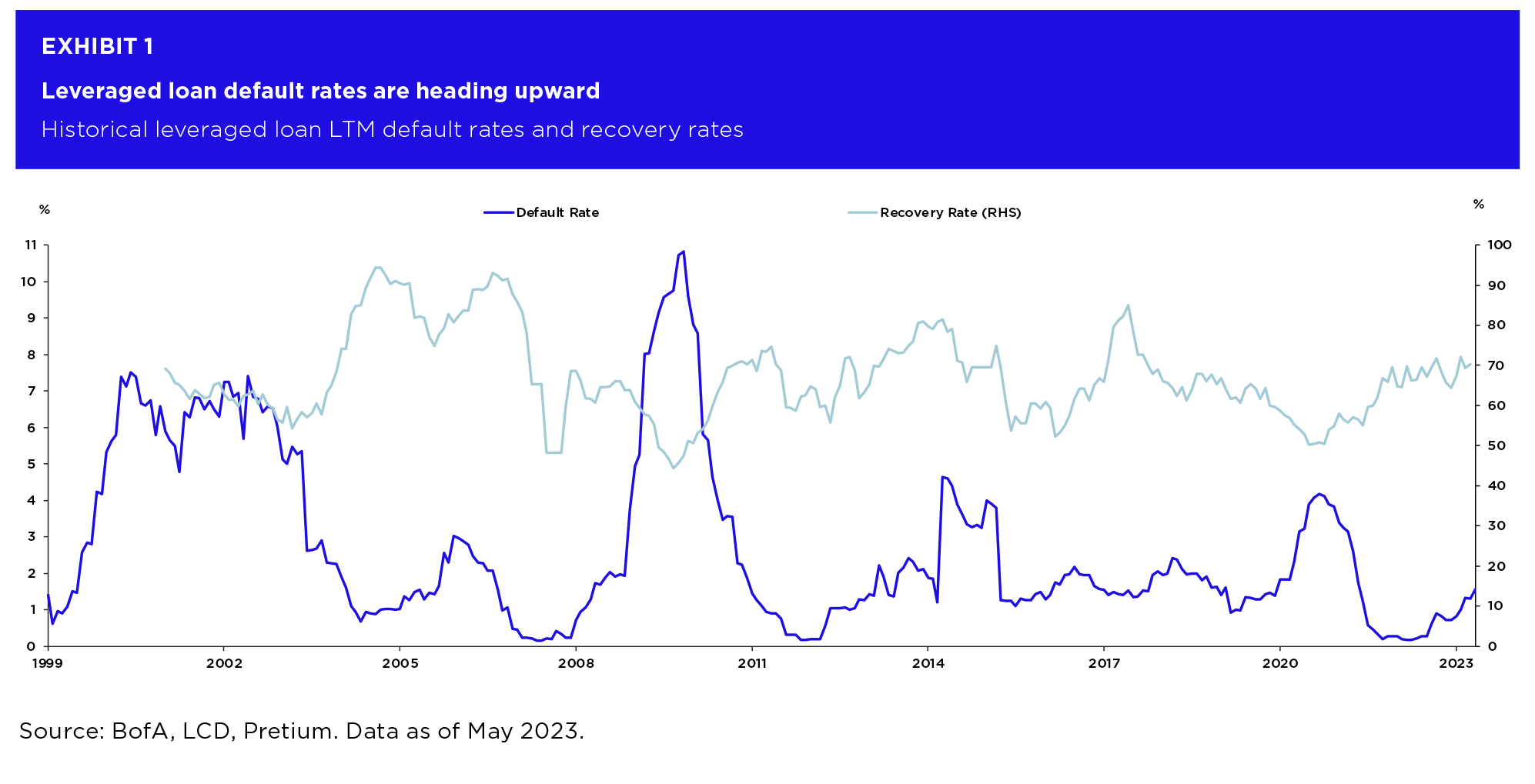

The junior portion of the CLO capital structure has seen solid performance so far in 2023. Over the course of the past several months, Pretium has highlighted this outperformance and made the argument that CLO mezzanine securities were undervalued relative to HY single-name credit, supporting this latter point by comparing the currently wide CLO BB spreads to the historical spread relationship the two asset classes have traditionally maintained. Given the uncertainty surrounding where the economy and the Federal Reserve may go from here, we have received inquiry from our investor base as to whether or not we view this outperformance as sustainable. In summary, we believe it is. Pretium believes that current CLO mezzanine and equity pricing reflects worst-case assumptions related to forward defaults and recoveries. While Pretium expects loan default rates to rise and recovery rates to remain depressed, we believe that current CLO spread and yield levels more than compensate for the fundamental strain that credit markets have already begun to realize and are likely to continue to experience over the coming quarters (Exhibit 1 below).

CLO BBs and CLO equity provided +8.6% and +7.6%, respectively, in (non-annualized) total returns over the first six months of the year vs. just +4.8% for HY corporate bonds1. Pretium believes this strong YTD performance for CLO instruments is sustainable across a variety of possible forward market outcomes. The market environment in the first half of 2023 reflected only muted spread changes and close to flat point-to-point long-term interest rate moves. Thus, the strong 23H1 CLO results for that period reflect what we see as only slightly above average expected returns for a sector which entered the year offering particularly generous spreads and yields.

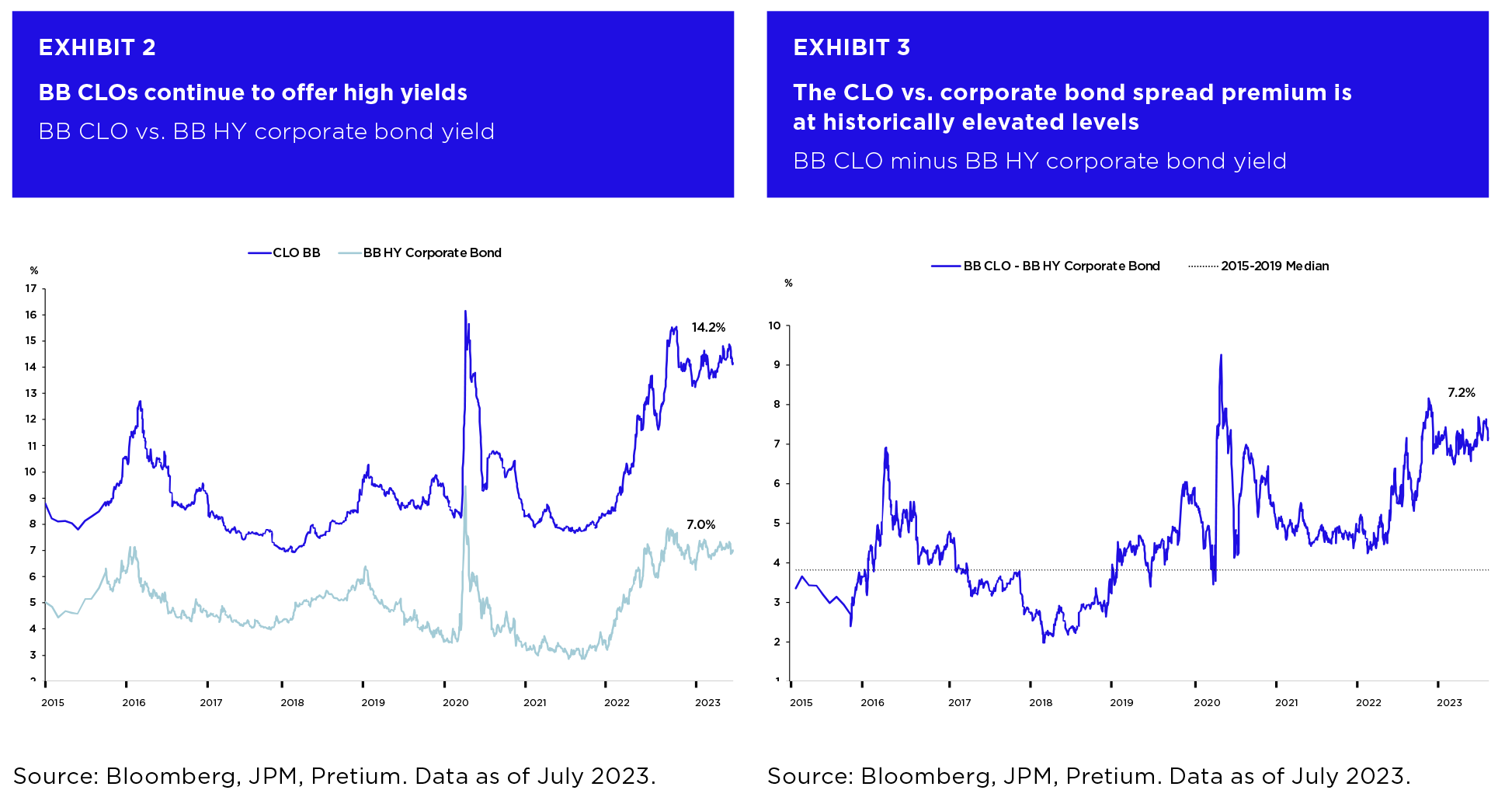

BB CLOs began 2023 with average yields of approximately 14%, reflecting SOFR margins at the time of over 900 basis points2. The strong total return for BB CLOs over the first half of 2023 largely reflected interest carry, as opposed to mark-to-market price gains which might have been harder to replicate in the future. By contrast, BB corporate bonds have yields-to-maturity of just 7%, with correspondingly smaller scope for carry returns (Exhibits 2-3 below).

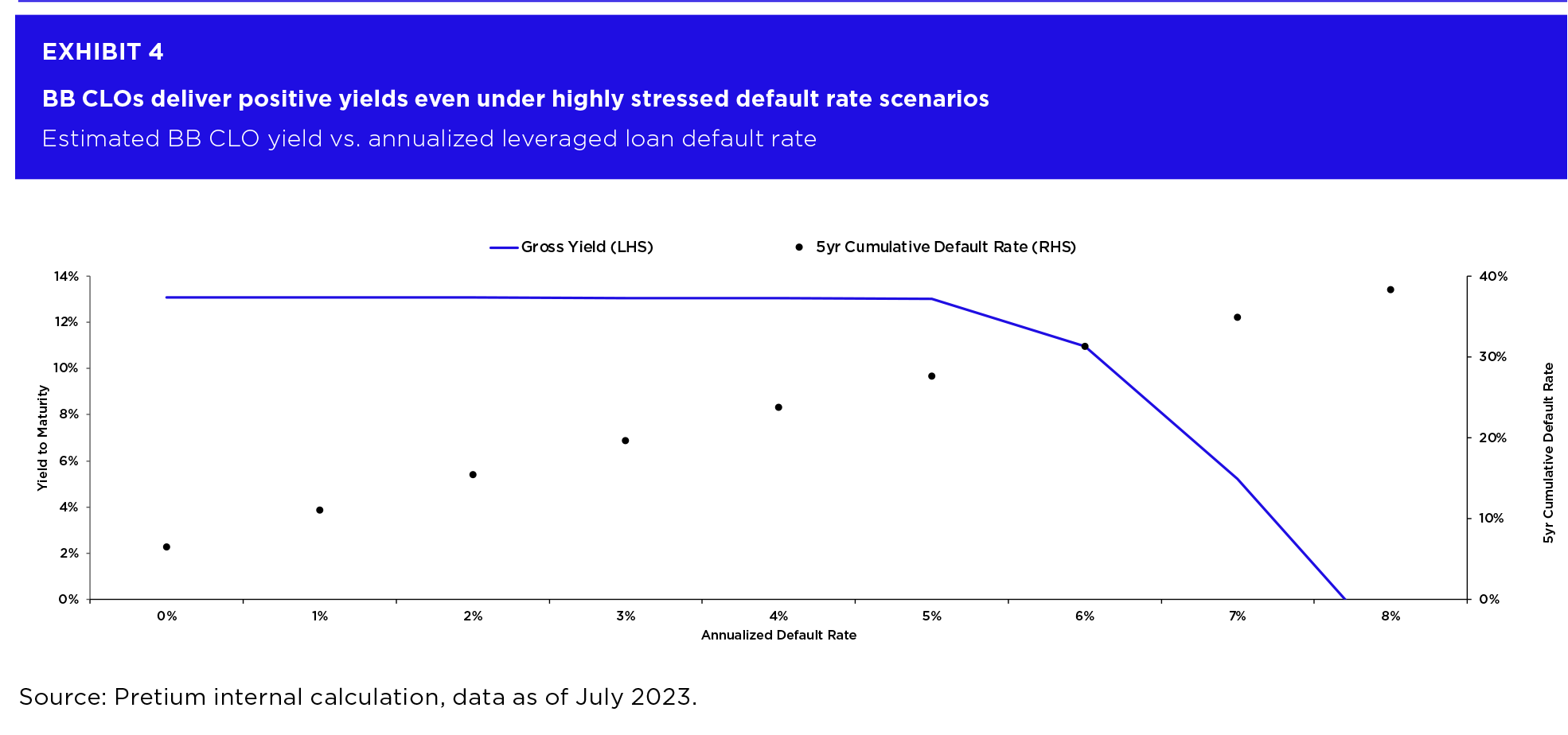

To assess the sustainability of CLO outperformance going forward in greater detail, we review expected returns for CLOs across a range of possible future interest rate and macro-economic scenarios. Our analysis suggests that mezzanine CLOs should outperform generic HY corporate bonds over a short-term (e.g., 1-year) horizon across most scenarios, with an even higher probability of outperformance over a hold-to-maturity horizon. Long-term expected returns for CLO BBs remain elevated under adverse scenarios at current pricing levels due to the fact that the investments benefit from significant structural protections which allow for full principal repayment under all but the most extreme default and recovery rate assumptions (Exhibit 4 below).

While CLO BBs can provide long-horizon downside protection in deep recession scenarios, CLO equity can complement the profile of CLO debt by offering a return distribution with significant upside potential in scenarios involving only mild recession or recovery. Combined, a portfolio which incorporates both CLO equity and CLO debt securities produces a highly attractive distribution of returns across a range of potential future economic outcomes.

Interest Rate Scenarios and Their Impacts on CLO Returns

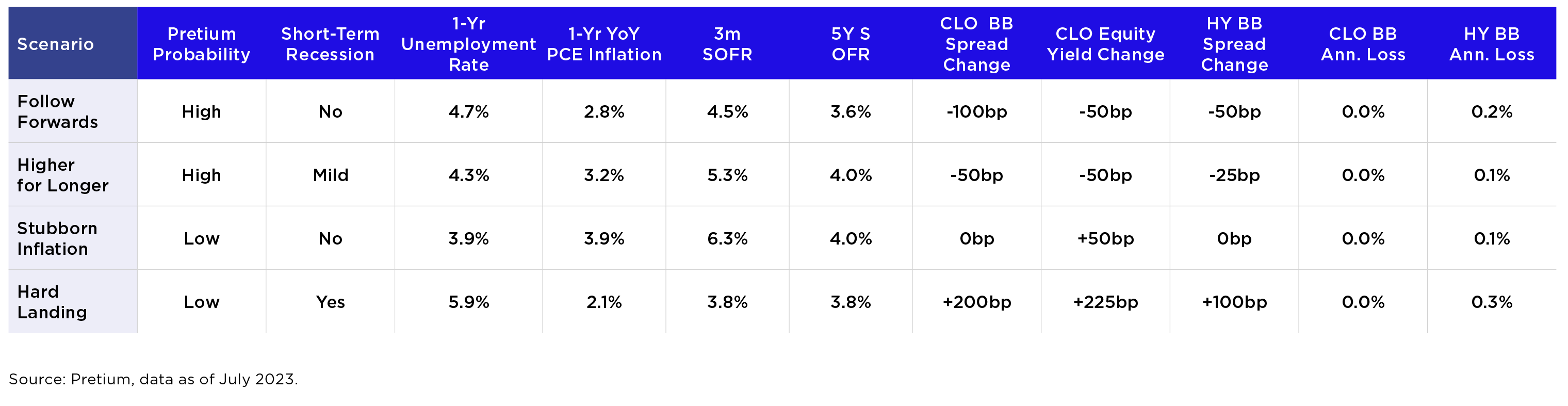

The scenarios we include in our analysis are:

- 1. Follow Forwards (high probability). Current interest rate curve plays out in line with current forwards, inflation continues to move down from current spot levels but remains above 2% target, unemployment ticks up modestly and corporate earnings stay flat or see a muted pullback: a soft landing scenario in which credit will outperform vs. current pricing and realized defaults are slightly below the market baseline forecast.

- 2. Higher for Longer (high probability). Interest rates stay higher for longer, remaining close to current spot levels, inflation comes down slightly but remains elevated, unemployment ticks up and corporate earnings stay flat or see a muted pullback: a soft landing scenario in which credit will marginally outperform vs. current pricing and defaults are in-line with the market baseline forecast.

- 3. Stubborn Inflation (low probability). The Federal Reserve hikes rates over the next twelve months in response to stubborn inflation and strong corporate earnings, inflation remains unchanged vs.current spot levels and unemployment remains low: a short term bullish market for credit with default rates lower than forecast due to strong corporate earnings.

- 4. Hard Landing (low probability). Material economic weakness emerges in the second half of 2023, inflation trails lower towards target and unemployment becomes elevated: a hard landing scenario for the economy and credit with short term and long term default rates above baseline forecasts and pulled forward.

Further detailed assumptions regarding these scenarios, including the assumed unemployment rate, inflation rate and short and longer term interest rates, are provided in Appendix A.

The calculations of expected CLO and corporate bond returns under the alternative scenarios incorporate both projected coupon income (e.g., with lower income for floating rate CLO instruments in falling rate scenarios) combined with, over the short horizon, expected mark-to-market price changes, and, over the longer term, potential realized credit losses.

Short-Term Outlook

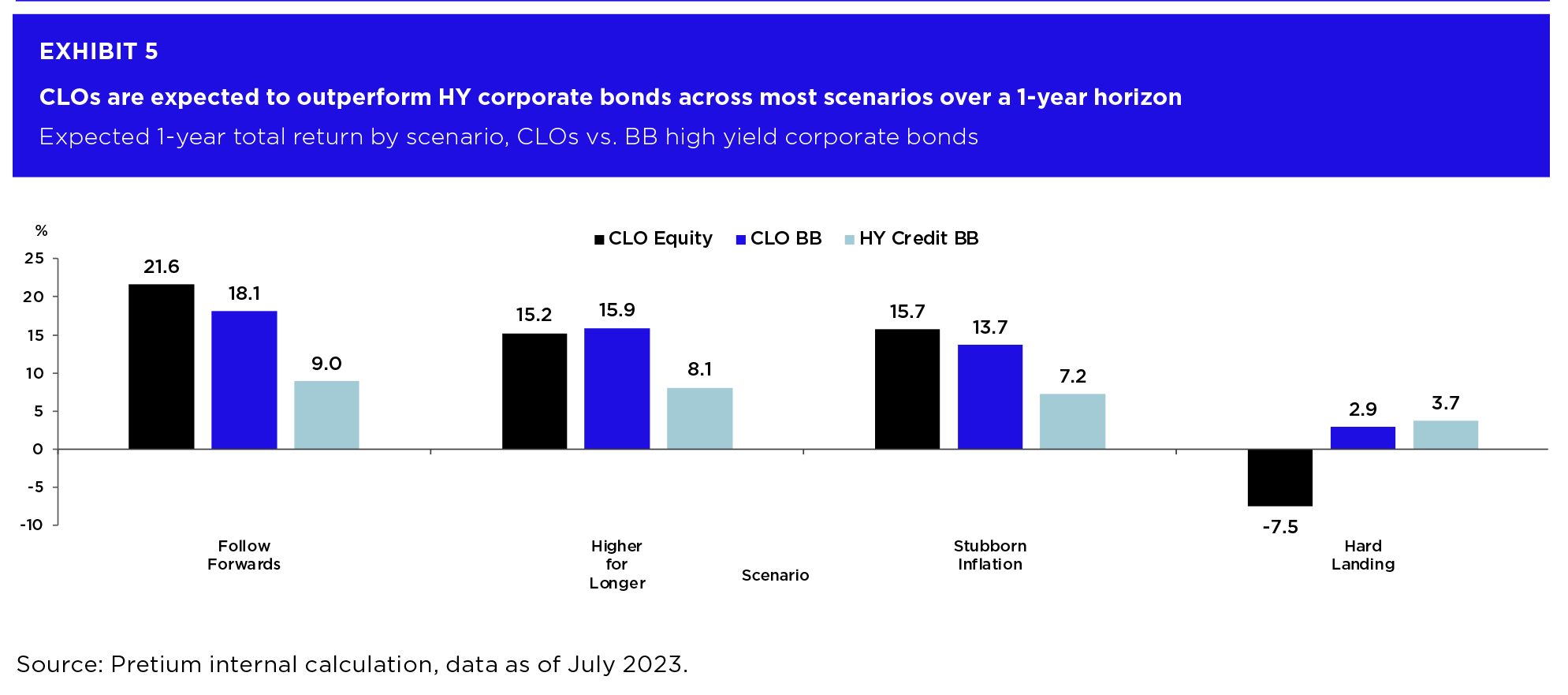

Exhibit 5 below shows the estimated scenario returns over a one-year horizon holding period. In scenarios 1 to 3 the returns for BB CLOs are projected to significantly exceed those for BB corporate bonds. This outperformance is driven by higher coupon income for CLOs. In effect, the projected outperformance of CLOs in these scenarios mirrors the recent historical outperformance of CLOs vs. HY bonds, which has also been largely driven by superior carry for the CLOs.

For scenario 4, a Hard Landing, CLO BBs are projected to deliver lower returns than fixed rate HY bonds. This modeled underperformance is a consequence of an expected decline in CLO floating rate coupons as the Federal Reserve cuts interest rates in response to an economic contraction, combined with an assumption that generic fixed rate bond spreads widen less sharply than CLO BB spreads into the contraction.

The short-term CLO equity performance estimates shown in Exhibit 5 are calculated from the cash-on-cash equity yields expected in these scenarios combined with expected instrument price changes; the price change estimates, in turn are estimated based on the historical relationships between CLO equity and HY bond prices across different market environments. In scenarios 1 to 3, CLO equity is projected to significantly outperform BB corporate bonds as high current carry is offset by only marginal changes in cash flow discount yields. Near-term changes to discount rates remain range-bound as default expectations over the first year are primarily constructed from credits that are already identified as candidates for default as a function of their current trading price. In scenario 4, CLO equity is projected to underperform as the pull-forward of defaults in credits that are currently trading above $90 is likely to result in a downward revision to forward cashflow projections combined with an increase in market yields used to discount the cashflows.

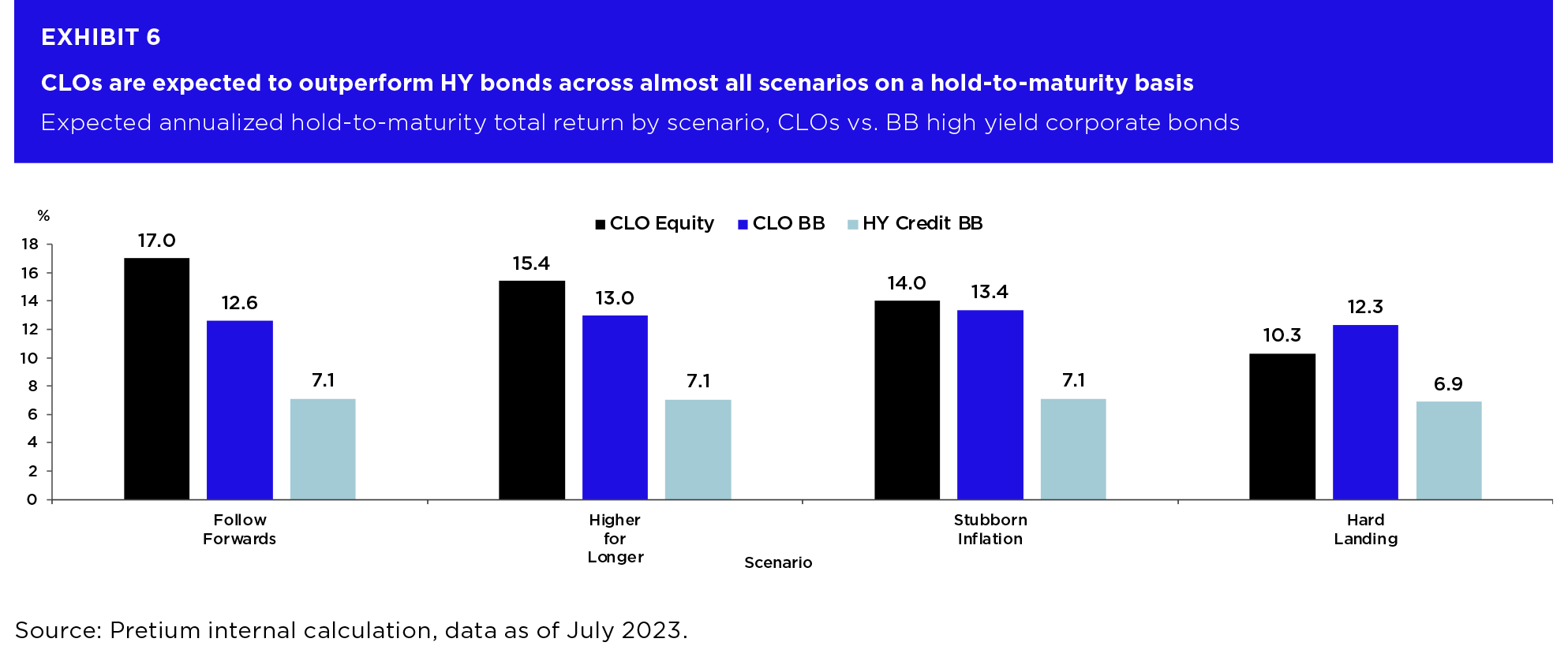

Hold-to-Maturity Outlook

Exhibit 6 shows the expected hold-to-maturity returns for the different asset classes across scenarios. Here, CLO BBs are projected to outperform HY BB bonds across all the scenarios, including the Hard Landing. Historically, only a small percentage of BB CLOs have ever experienced principal losses, including during the global financial crisis period, due largely to the structural protections from which the bonds benefit3. Accordingly, we project no CLO BB losses under the four scenarios considered. Generic HY corporate bonds lack these structural protections and hence, are projected to experience small but non-zero performance drags due to defaults, which are modeled here as ranging from a 0.1% annualized yield degradation in the more benign scenarios to a 0.3% yield impairment in the Hard Landing scenario. Most of the projected BB CLO vs. BB corporate bond outperformance though, comes not from differences in credit loss assumptions but rather, from the substantially wider spreads CLO BBs currently contain, which helps generate much stronger carry income over the lives of the respective bonds.

While CLO debt is seen in Exhibit 6 to provide high prospective yields and significant long-horizon downside protection, CLO equity offers a return distribution with significant upside potential in scenarios involving milder recession or recovery. For example, in the Follow Forwards scenario, CLO equity would be expected to deliver a 17% annualized return. Combined, a portfolio incorporating CLO equity and CLO BB securities can produce a risk-return profile superior to those available in public equity or single-name HY credit markets.

The hold-to-maturity CLO equity performance estimates in Exhibit 6 are based on IRR calculations which project CLO equity cash flows under the alternative scenarios. The modeled CLO equity held-to-maturity return is lowest in the Hard Landing scenario, in which loan default rates are assumed to be relatively elevated and CLO equity cash flows are consequently reduced. Lower interest rates in this scenario also put downward pressure on CLO equity cash flows in this adverse scenario. Even in the Hard Landing scenario however, we project a portfolio of CLO equity securities to ultimately deliver low double-digit IRRs given the currently favorable pricing of these instruments

Summary

Our analyses suggest that the strong total returns delivered by CLO mezzanine debt and equity securities in the first half of 2023 are sustainable going forward given current pricing. An analysis of the projected returns for CLOs vs. fixed rate HY corporate bonds suggests that CLOs should outperform over a 1-year horizon across most economic scenarios, with outperformance even more probable over longer holding periods. Pretium believes the attractive relative value provided by a portfolio of CLO equity and CLO BBs clearly indicates that CLOs should be an integral component for every allocator looking to optimize their corporate credit exposure in this environment.

Appendix A — Economic scenario assumptions

1 Source: Bank of America, Bloomberg, JPM, data as of June 30, 2023.

2 Source: JPM CLOIE, data as of July 17, 2023.

3 Source: “CLO Performance”, Federal Reserve Bank of Philadelphia, WP 20-48, November, 2021.

Disclosure

This confidential presentation was prepared exclusively by Pretium for the benefit and internal use of the party to whom it is directly addressed and delivered (the “Recipient”). None of the materials, nor any content, may be altered in any way, transmitted to, copied, reproduced or distributed in any format in whole or in part to any other party without the prior express written consent of Pretium. As used in this presentation, “Pretium” refers to Pretium Partners, LLC and/or its affiliates.

Pretium’s Credit investment strategies are focused on corporate credit, structured products collateralized by corporate credit, and legal opportunities financing. The team invests in broadly syndicated loans, as well as securities issued by CLOs. Investments in non-investment grade companies are subject to greater risk of loss of principal and interest than higher-rated investments and are generally considered to be predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal. Litigation finance depends on whether the cases in which the fund invests will be successful, will pay the targeted returns and will pay those returns in the anticipated time. Assessing the values, strengths and weaknesses of a case is complex and the outcome is not certain. Should cases, claims, defenses or disputes in which the fund invests prove to be unsuccessful or produce returns below those expected, the performance of the fund could be materially adversely affected. Furthermore, laws and professional regulations in litigation funding can be complex and uncertain and details of certain cases are unlikely to be disclosed because of confidentiality and other restrictions.

There can be no assurance that Pretium’s objectives will be achieved, that any risk management will adequately protect against downside losses, or that an investor will receive any return on its investment. An investment should only be considered by persons who can afford a loss of their entire investment. Past activities of investment entities sponsored by Pretium provide no assurance of future results. Past or targeted performance is not a guarantee, projection or prediction and is not necessarily indicative of future results.

These materials do not constitute, or form part of, any offer to sell or issue interests in an investment vehicle or any other entity. Any such offer or solicitation will be made solely by means of a definitive offering document, which will describe the actual terms of any securities offered and will contain material information regarding the securities. Any information contained herein will be superseded by information delivered to Recipient as part of an offering document. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein.

Past performance is not necessarily indicative of future results and there can be no assurance that targeted returns will be achieved. There can be no assurance that Pretium will achieve results comparable to or that the returns generated will equal or exceed those of other investment activities of Pretium or that Pretium will be able to implement its investment strategy or achieve its investment objectives. Pretium does not make any representation or warranty, express or implied, regarding future performance.

Certain information contained in these materials constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “project,” “estimate,” intend,” continue,” “target,” “plan,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results of the actual performance of an investment vehicle or strategy may differ materially from those reflected or contemplated in such forward-looking statements.

Certain information contained in this presentation has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, Pretium has not independently verified such information nor does it assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof.

These materials are intended to assist the Recipient in connection with its due diligence and to assist the Recipient in understanding the strategies that Pretium intends to pursue to seek to maximize portfolio performance. They are not intended as a representation or warranty by Pretium as to the actual composition or performance of any future investments that would be made by Pretium. Assumptions necessarily are speculative in nature. It is likely that some or all of the assumptions underlying the potential investments will not materialize or will vary significantly from any assumptions made (in some cases, materially so). The Recipient should understand such assumptions and evaluate whether they are appropriate for its purposes.

Recipients should note that COVID-19 has, among other things, significantly diminished global economic production and activity of all kinds and has contributed to both volatility and a decline in all financial markets. The ultimate impact of COVID-19 — and the resulting precipitous and near-simultaneous decline in economic and commercial activity across several of the world’s largest economies — on global economic conditions, and on the operations, financial condition and performance of any particular industry or business, is impossible to predict, although ongoing and potential additional materially adverse effects, including a further global or regional economic downturn (including a recession) of indeterminate duration and severity, are possible. The extent of COVID-19’s impact will depend on many factors, including the ultimate duration and scope of the public health emergency and the restrictive countermeasures being undertaken, as well as the effectiveness of other governmental, legislative and financial and monetary policy interventions designed to mitigate the crisis and address its negative externalities, all of which are evolving rapidly and may have unpredictable results. Even if and as the spread of the COVID-19 virus itself is substantially contained, it will be difficult to assess what the longer-term impacts of an extended period of unprecedented economic dislocation and disruption will be on future macro- and micro-economic developments, the health of certain industries and businesses, and commercial and consumer behavior.