Confidentiality and Other Important Disclosures

This confidential presentation was prepared exclusively by Pretium for the benefit and internal use of the party to whom it is directly addressed and delivered (the “Recipient”). None of the materials, nor any content, may be altered in any way, transmitted to, copied, reproduced or distributed in any format in whole or in part to any other party without the prior express written consent of Pretium. As used in this presentation, “Pretium” refers to Pretium Partners, LLC and/or its affiliates.

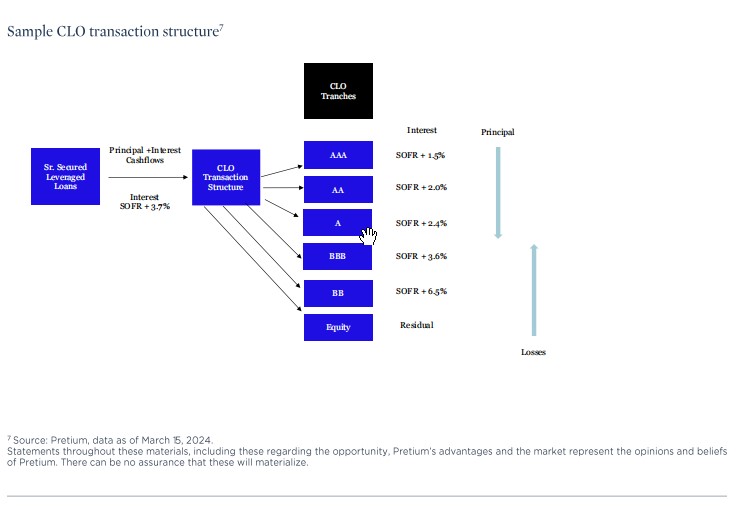

Pretium’s Credit investment strategies are focused on corporate credit, structured products collateralized by corporate credit, distressed debt and equity and legal opportunities financing. The team invests in broadly syndicated loans, debt and equity of public and private companies, as well as securities issued by CLOs. Investments in high yield securities are subject to greater risk of loss of principal and interest than higher-rated securities and are generally considered to be predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal. Investments in distressed situations expose the investor to the difficulty in obtaining information as to the issuer’s true condition; legal risk, including laws relating to fraudulent conveyances, voidable preferences, lender liability, and bankruptcy; litigation risk; and liquidity risk. In addition, accounts will not be diversified among a wide range of types of securities, industry, markets, or countries. Litigation finance depends on whether the cases in which the fund invests will be successful, will pay the targeted returns and will pay those returns in the anticipated time. Assessing the values, strengths and weaknesses of a case is complex and the outcome is not certain. Should cases, claims, defenses or disputes in which the fund invests prove to be unsuccessful or produce returns below those expected, the performance of the fund could be materially adversely affected. Furthermore, laws and professional regulations in litigation funding can be complex and uncertain and details of certain cases are unlikely to be disclosed because of confidentiality and other restrictions.

There can be no assurance that Pretium’s objectives will be achieved, that any risk management will adequately protect against downside losses, or that an investor will receive any return on its investment. An investment should only be considered by persons who can afford a loss of their entire investment. Past activities of investment entities sponsored by Pretium provide no assurance of future results. Past or targeted performance is not a guarantee, projection or prediction and is not necessarily indicative of future results.

These materials do not constitute, or form part of, any offer to sell or issue interests in an investment vehicle or any other entity. Any such offer or solicitation will be made solely by means of a definitive offering document, which will describe the actual terms of any securities offered and will contain material information regarding the securities. Any information contained herein will be superseded by information delivered to Recipient as part of an offering document. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein.

Past performance is not necessarily indicative of future results and there can be no assurance that targeted returns will be achieved. There can be no assurance that Pretium will achieve results comparable to or that the returns generated will equal or exceed those of other investment activities of Pretium or that Pretium will be able to implement its investment strategy or achieve its investment objectives. Pretium does not make any representation or warranty, express or implied, regarding future performance.

Certain information contained in these materials constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “project,” “estimate,” intend,” continue,” “target,” “plan,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results of the actual performance of an investment vehicle or strategy may differ materially from those reflected or contemplated in such forward-looking statements.

Certain information contained in this presentation has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, Pretium has not independently verified such information nor does it assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof.

These materials are intended to assist the Recipient in connection with its due diligence and to assist the Recipient in understanding the strategies that Pretium intends to pursue to seek to maximize portfolio performance. They are not intended as a representation or warranty by Pretium as to the actual composition or performance of any future investments that would be made by Pretium. Assumptions necessarily are speculative in nature. It is likely that some or all of the assumptions underlying the potential investments will not materialize or will vary significantly from any assumptions made (in some cases, materially so). The Recipient should understand such assumptions and evaluate whether they are appropriate for its purposes.

Recipients should note that COVID-19 has, among other things, significantly diminished global economic production and activity of all kinds and has contributed to both volatility and a decline in all financial markets. The ultimate impact of COVID-19 — and the resulting precipitous and near-simultaneous decline in economic and commercial activity across several of the world’s largest economies — on global economic conditions, and on the operations, financial condition and performance of any particular industry or business, is impossible to predict, although ongoing and potential additional materially adverse effects, including a further global or regional economic downturn (including a recession) of indeterminate duration and severity, are possible. The extent of COVID-19’s impact will depend on many factors, including the ultimate duration and scope of the public health emergency and the restrictive countermeasures being undertaken, as well as the effectiveness of other governmental, legislative and financial and monetary policy interventions designed to mitigate the crisis and address its negative externalities, all of which are evolving rapidly and may have unpredictable results. Even if and as the spread of the COVID-19 virus itself is substantially contained, it will be difficult to assess what the longer-term impacts of an extended period of unprecedented economic dislocation and disruption will be on future macro- and micro-economic developments, the health of certain industries and businesses, and commercial and consumer behavior.