The popular housing narrative overstates the mortgage rate lock-in effect

Structural supply-demand imbalance is the reason home prices are rising, not higher mortgage rates

Despite the most substantial mortgage rate impact on homebuyers in the modern history of housing, US single-family home prices are up roughly 5% year-to-date through the third quarter.1 The surprising resilience of home prices has confounded housing observers and led most housing narratives to focus in on the mortgage rate lock-in effect as the root cause of rising home prices. Even Federal Reserve officials have publicly stated that rising interest rates have contributed to rising home prices through the mortgage rate lock-in effect.2 Mortgage rate lock-in as a driver of reduced mobility is a documented phenomenon3 and it is likely that some homeowners have not listed their homes as a result of the sharp increase in mortgage rates; however, we believe the lock-in phenomenon has been overemphasized in the popular housing narrative. Moreover, the argument that mortgage rate lock-in aggravates housing’s supply-demand imbalance (and therefore increases home prices) confuses listings of existing homes for housing inventory, in our view. If rates fall, Pretium believes it is more likely that housing’s supply-demand imbalance will incrementally worsen, not improve. As we have written previously, the pandemic structurally increased demand for single-family homes after a prolonged period of underproduction.4 This structural supply-demand imbalance remains a more likely candidate for why home prices have been resilient during 2023 rather than the mortgage rate lock-in effect.

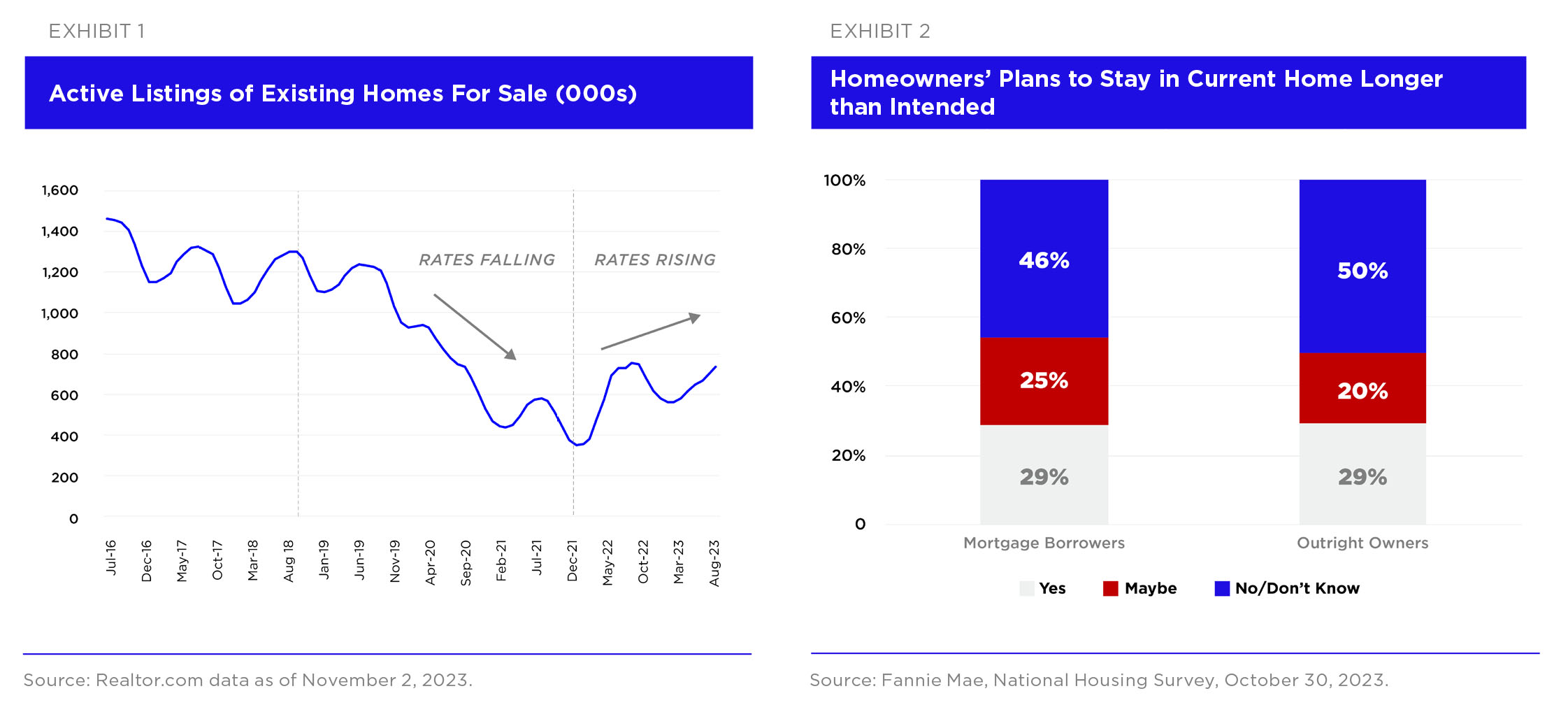

The main argument of the mortgage rate lock-in thesis is that listings of existing homes have fallen due to higher rates but Exhibit 1 shows that this isn’t the case. Active listings fell from 2019-2021 as mortgage rates fell and have been increasing since the beginning of 2022. The pace of transactions has fallen at a faster rate than the pace of new listings, driving up both overall resale listings and months of supply. Fannie Mae’s National Housing Survey asked earlier this year whether mortgage rates were a factor in homeowners’ plans to stay longer in their current homes and the results “…suggest that a fairly strong majority of mortgage borrowers’ future moving plans may not be affected by their mortgage rate”.5 As shown in Exhibit 2, there was little difference in the moving intentions of mortgage borrowers vs. outright owners.

An important underlying assumption of the mortgage rate lock-in effect thesis is that homeowners’ choice not to list their homes reduces housing inventory; however, if rates fell and a greater number of homeowners listed their homes, they would be both buyers and sellers. Furthermore, according to the lock-in thesis these households would largely be discretionary buyers/sellers and therefore unlikely to accept offers that would cause home prices to decline. Finally, to the extent that most homeowners cannot perfectly time the sale of their current home and the purchase of their new home, increased transactions by locked-in homeowners would likely lead to some households temporarily occupying two homes thereby decreasing overall housing inventory.

Statements throughout the research above represent the opinions and beliefs of Pretium. There can be no assurance that these will materialize.

- CoreLogic, US Home Price Insights as of November 7, 2023.

- “Higher Rates Contribute to Rising Home Prices, Fed’s Harker Says”, Bloomberg, October 16, 2023.

- “Mortgage Lock-In, Mobility, and Labor Reallocation”, Fonseca and Liu, June 2023.

- “In forecasting home prices, the last housing cycle is a poor guide for this one”, Pretium Housing Insights, September 21, 2022.

- “’Lock-In Effect’ not the only reason for housing supply woes”, Fannie Mae as of October 30, 2023.