Summary

Single-family and multifamily supply outlooks have diverged meaningfully.

It will likely take much longer to absorb multifamily vs. single-family units under construction.

During the pandemic, both single-family and multifamily construction climbed in response to strong home purchase and rental demand. The contraction in construction over the past nine months has played out differently, with single-family construction falling sharply while multifamily construction has been much slower to react. As of January, single-family starts have been falling for a year and are already down 35% from their pandemic peak; on the other hand, multifamily starts were still reaching new multidecade highs in November1. The differing trajectories are partly driven by the inherently greater flexibility of single-family homebuilding where each unit is started independently vs. multifamily projects where all units in a structure are started at once. Also, single-family projects typically have shorter timelines and are less complex compared to multifamily projects2. Finally, since 95% of singlefamily homes are built for homeowners, their rate of building is especially sensitive to changes in consumer behavior and mortgage rates; on the other hand, 94% of multifamily units are built for investors who have longer-term time horizons3.

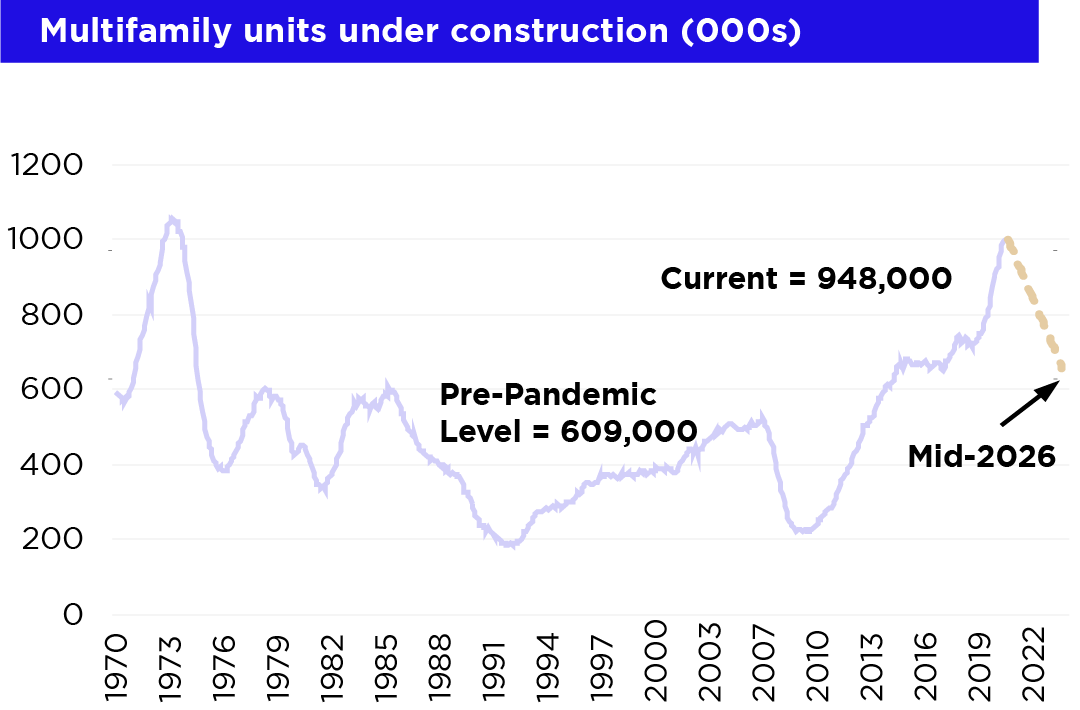

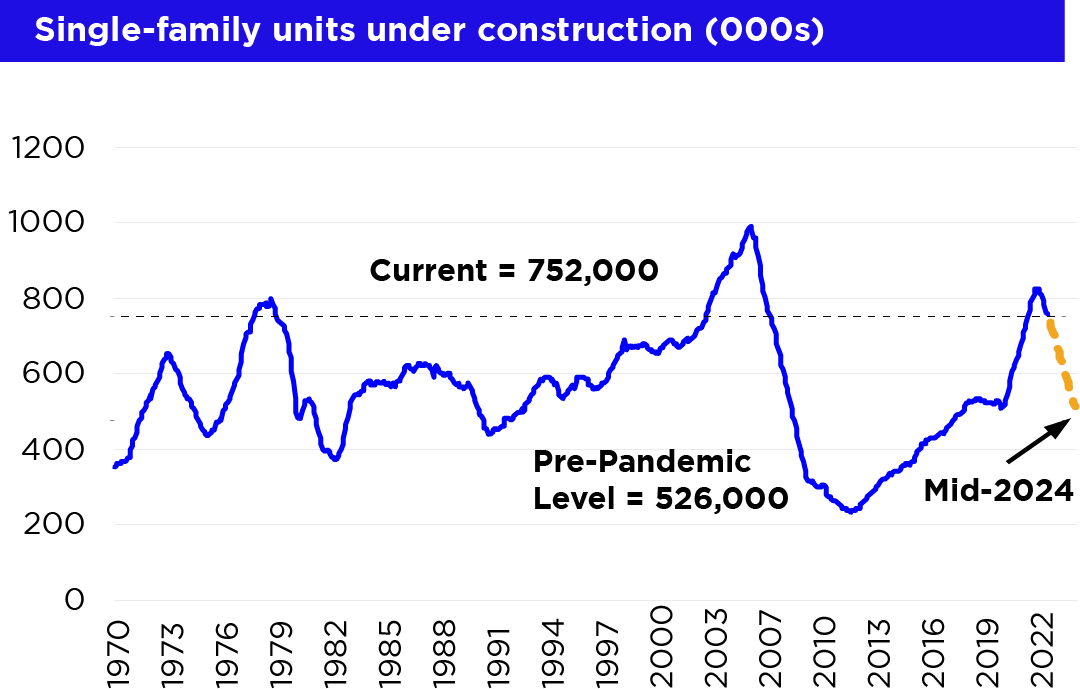

The difference in trajectories of single-family vs. multifamily construction has important implications for the rate at which construction backlogs are likely to be worked down. The number of housing units under construction reached record highs during the pandemic driven by the synchronized surge in home purchase and rental demand. The sharp contraction in single-family construction means that as of January, the pace of single-family completions is 45% higher than the pace of new single-family units being permitted1. As shown in Exhibit 1, single-family construction backlogs have been falling since mid-2022 and at their current pace of decline will be back at pre-pandemic levels by mid-2024. By contrast, multifamily construction backlogs are still rising since multifamily permits remain 70% higher than multifamily completions. As shown in Exhibit 2, multifamily construction backlogs are approaching their all-time highs of 994,000. Even if multifamily construction backlogs began to decline immediately, Pretium estimates that it could take until mid-2026 for multifamily construction backlogs to return to their pre-pandemic levels.

As described in Pretium’s November 2022 Housing Insights, we believe that supply-demand imbalance will remain a central driver of US housing market dynamics4. Elevated construction pipelines aren’t enough to resolve a supply-demand imbalance that measures in the millions5; however, they do represent both an investment risk and opportunity as developers work their backlogs down. Over the next 12-18 months, we expect single-family homebuilders to continue to be proactive in working to reduce their construction backlogs, but not in a manner broadly disruptive to single-family home prices. The multifamily outlook is cloudier given the continued momentum of construction and the potentially long period over which it will be resolved.

Exhibit 1

Exhibit 2

Source: US Census, New Residential Construction, as of January 2023.

Want more Housing Insights from Pretium?: Increased long-distance migration persisted in 2022

This is not an offer, advertisement, or solicitation for interests in any Pretium managed vehicle and should not be construed or relied upon as investment advice or as predictive of future market or investment performance. Past performance is not indicative of future results.

1. US Census, New Residential Construction, as of January 2023.

2. NAHB, “Slightly Longer Time to Build Apartments in 2021”, July 7, 2022 and “How Long Does it Take to Build a Single-Family Home”, September 30, 2020.

3. US Census, “Quarterly Starts and Completions by Purpose and Design”, as of 3Q22.

4. Pretium Housing Insights, “The US is already underbuilding again, worsening the long-term supply shortage”, November 2022.

5. Pretium White Paper, “The US Housing Shortage”, October 26, 2021.