Resilient single-family home prices have diverged from commercial real estate prices

Supply-demand imbalance has supported home prices despite record rate shock

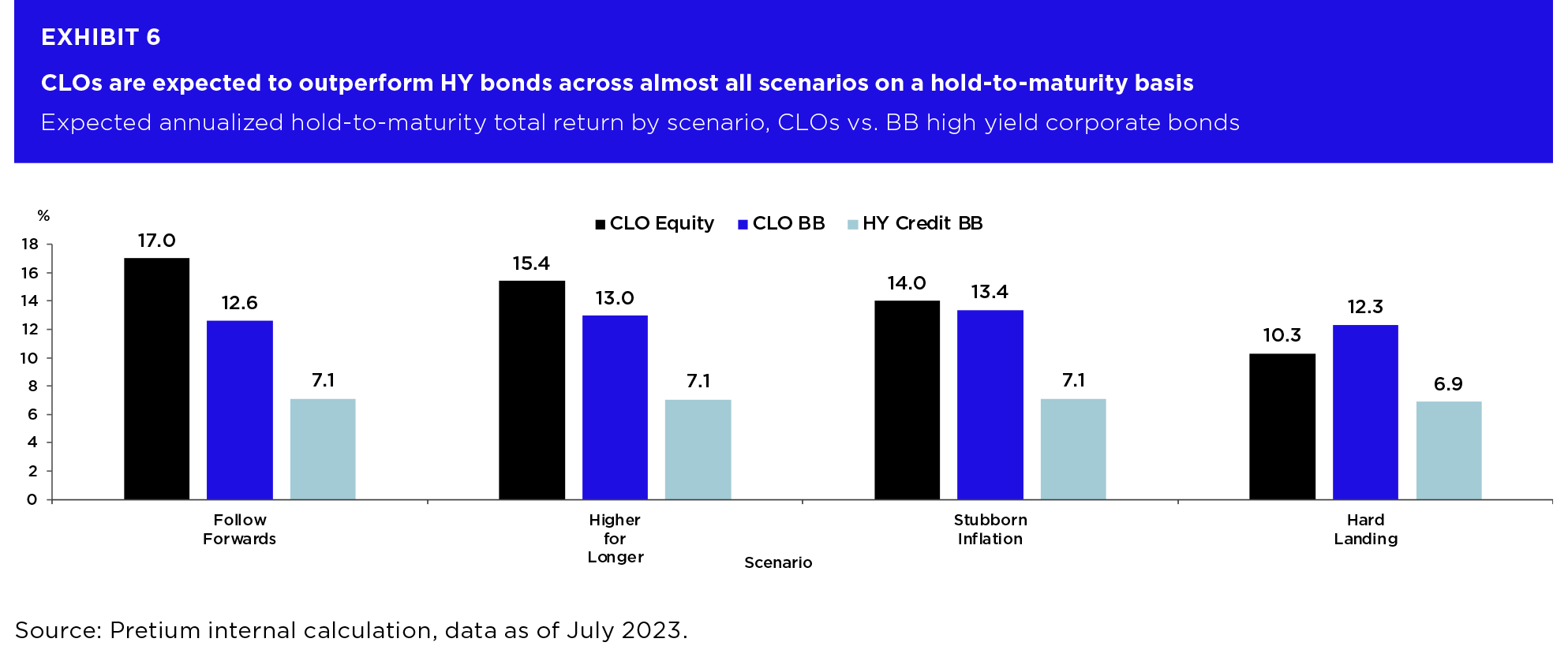

Since the Federal Reserve began its campaign to raise interest rates in early 2022, there has been a marked divergence between the price trends of single-family and traditional commercial real estate. Major commercial property price indices show declines from recent peak values of as much as 10-15%1 ; meanwhile, single-family residential prices declined only briefly during 2H22 and have gone on to set new all-time highs during 2023.2 This price divergence is illustrated in Exhibit 1 and is a departure from prior rate cycles when different real estate sub-sectors had similar rate sensitivities.

Differing financing structures is one widely discussed factor that has likely created greater rate sensitivity for commercial real estate – its financing is typically shorter in term and relies more on floating interest rates. More than 40% of commercial real estate debt matures through 2025; furthermore, roughly one-third is floating rate.3 For single-family homes, 80-90% of mortgage loans originated over the past decade have had fixed 30-year rates with most of the remainder fixed for either 5 or 7 years.4 While financing differences are important, they don’t fully explain why single-family home prices have set new highs despite the largest rate shock in the modern history of US housing. A less discussed but potentially more important factor explaining the surprising resilience of singlefamily prices is a more favorable supply-demand dynamic when compared to commercial real estate.

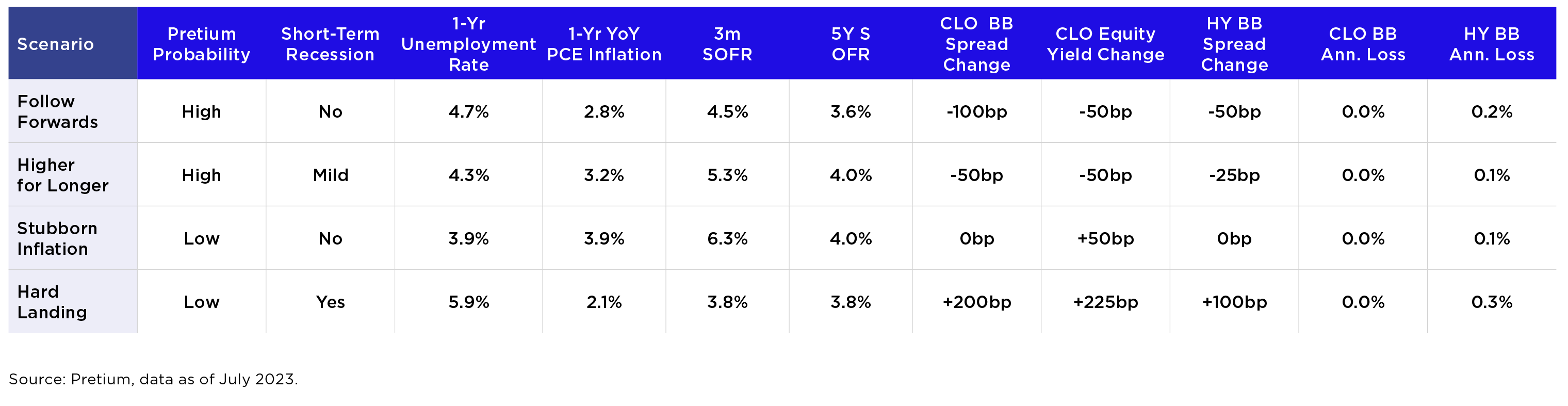

The pandemic has likely structurally increased demand for housing, especially single-family homes.5 In terms of supply, single-family housing has seen less investment relative to demand since the Great Financial Crisis (GFC). This is illustrated in Exhibit 2, which compares construction spending for different real estate asset types. Multifamily and industrial have emerged as the two pillars of most investors’ real estate strategies and in response investment in new construction has increased more than fivefold over the past quarter century. By contrast, fundamentals for retail and office have proven more challenging and construction has grown slowly. Single-family construction grew during the mid-2000s, but it has seen slower growth during the post-GFC period. Overall, single-family investment has grown in-line with office investment despite a stronger demand profile.

Within single-family housing, single-family rentals have experienced a net reduction in supply over the past few years as described in the October 2022 Pretium Housing Insights.6 Single-family rentals are arguably the only real estate asset type to have seen supply shrink over the past few years. Looking ahead, Pretium expects that favorable supply-demand dynamics will continue to underpin single-family fundamentals in the coming years, both in terms of rent and price growth.

Statements throughout these materials, including these regarding the opportunity, Pretium’s advantages and the market represent the opinions and beliefs of Pretium. There can be no assurance that these will materialize.

- Real Capital Analytics, Commercial Property Price Indices as of July 20, 2023; Green Street, Commercial Property Price Index as of August 4, 2023.

- CoreLogic, Home Price Index as of September 5, 2023.

- Mortgage Bankers Association, Quarterly Commercial/Multifamily Mortgage Debt Outstanding as of June 29, 2023.

- CoreLogic, “Rising Rates Lead to Increase in Adjustable-Rate Mortgage (ARM) Activity”, June 26, 2023.

- Pretium Housing Insights, “Increased long-distance migration persisted in 2022”, January 2023.

- Pretium Housing Insights, “Investor activity in housing had no discernible impact on homeownership during the pandemic”, October 2022.